Tether Holds Its Ground Despite Regulatory Shifts

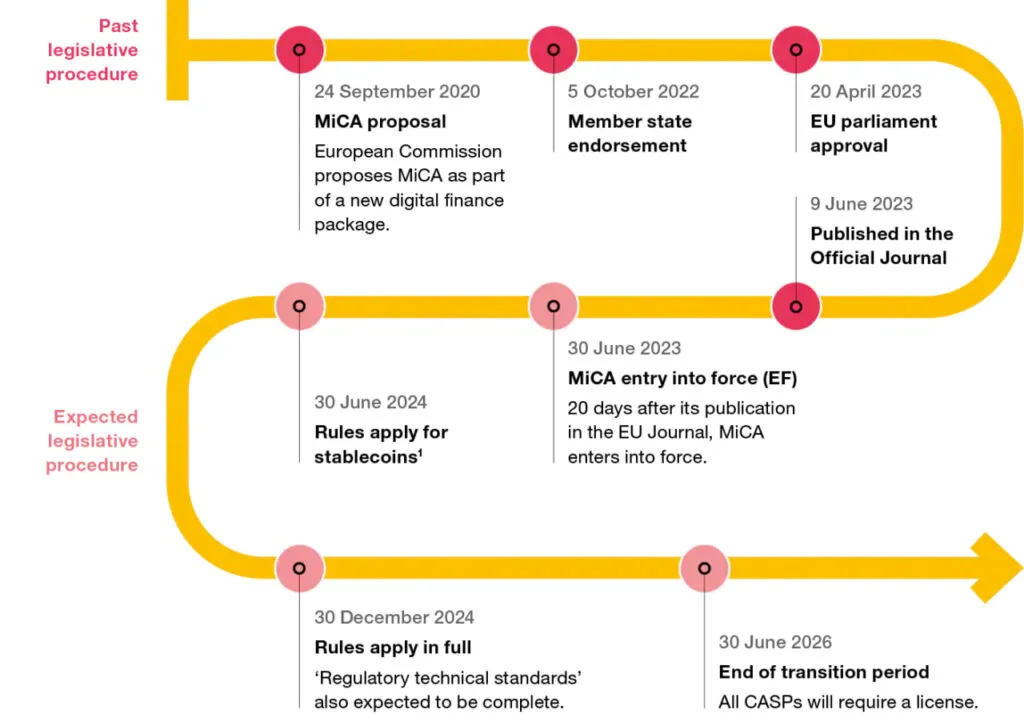

The Markets in Crypto-Assets Regulation (MiCA) has set a clear legal framework for stablecoins, prioritizing transparency, stability, and investor protection across the EU. As regulatory oversight tightens, what’s next for Tether (USDT)?

On this page

Key MiCA Regulations Impacting Stablecoins

MiCA enforces strict new requirements for stablecoin issuers, aimed at ensuring greater financial security and compliance. The major provisions include:

- Stablecoin issuers must be authorized by national regulators in the EU, ensuring only compliant stablecoins can operate within the region.

- Issuers must hold sufficient liquid reserves to fully back issued stablecoins. These reserves must consist of fiat currencies, government securities, or precious metals, ensuring full redemption at face value.

- Issuers are required to disclose their reserve holdings, including composition, valuation, and storage locations, and conduct annual independent audits to verify compliance.

- If an issuer goes bankrupt, stablecoin holders must be compensated based on the issuer’s audited reserves.

- MiCA prohibits stablecoins that rely on algorithmic price stabilization mechanisms rather than full asset backing.

- Stablecoins not pegged to the euro, such as USDT (pegged to USD), are subject to a cap of 1 million transactions or €200 million in nominal value within the EU.

The MiCA framework aims to mitigate risks associated with stablecoins while promoting euro-denominated assets to reduce reliance on foreign currencies in the European market.

Read more: How MiCA Will Reshape the European Crypto Market

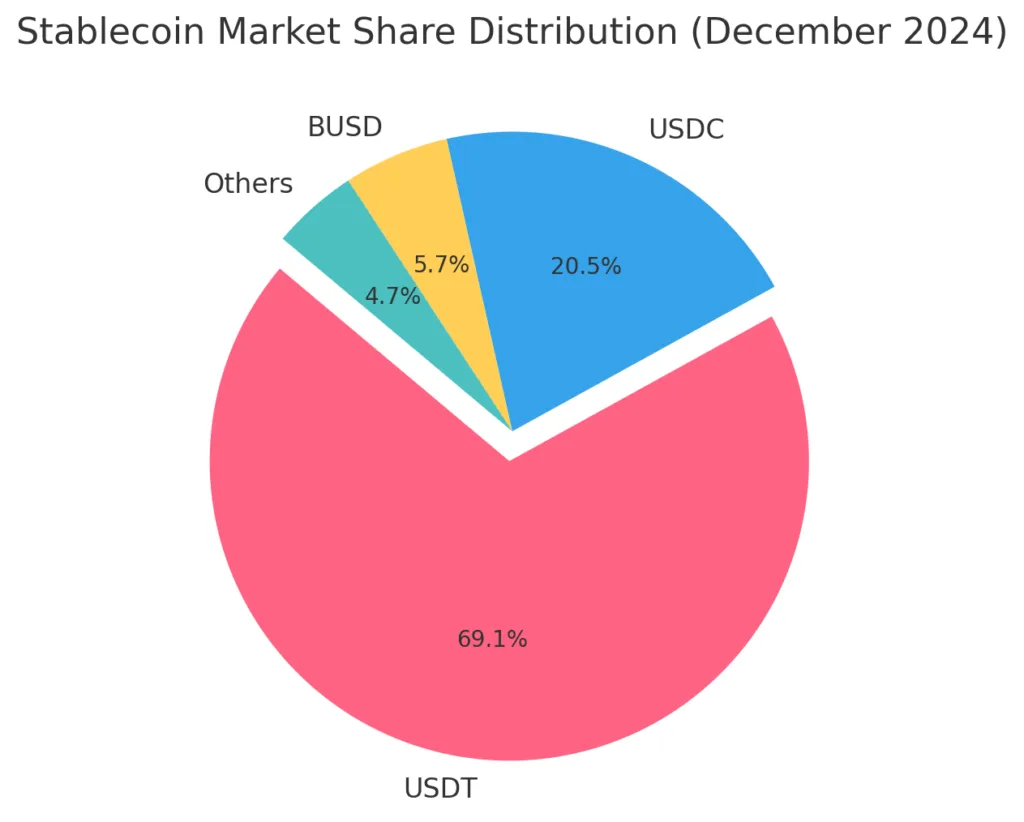

USDT’s Position in the Global Stablecoin Market

As is evident, Tether fails to meet five out of six key regulatory requirements: it lacks an official license from European regulators and has never undergone an independent audit by certified third-party auditors (all past audits were conducted by accounting firms with indirect ties to Tether).

Additionally, Tether’s CEO has only stated plans to publish regular reserve reports, but so far, these remain intentions rather than actions.

The most notable development came when Tether announced it would discontinue support for EUR₮, its euro-pegged stablecoin, citing a lack of market demand.

Nevertheless, USDT remains the world’s largest stablecoin and a critical part of the crypto ecosystem. As of January 29, Coingecko data shows USDT’s global daily trading volume exceeded $64 billion.

This popularity is driven by high liquidity, broad adoption on non-European exchanges, and the stability of its U.S. dollar peg.

As of September 2024, Tether (USDT) controlled approximately 75% of the global stablecoin market, marking a significant increase from 55% two years earlier. Its market capitalization exceeded $118 billion. However, by December 2024, USDT’s market share declined slightly, primarily due to growing competition from other stablecoins, particularly USDC and FDUSD.

The rise of competitors, especially USDC, is fueled by increasing demand for regulated and transparent stablecoins. USDC, issued by Circle, has received full regulatory approval under MiCA, solidifying its position as the only officially recognized stablecoin in the European market. Meanwhile, Tether continues to face scrutiny over the transparency of its reserves and compliance with MiCA’s new regulatory standards.

Related: Binance and Circle Form Alliance to Challenge Tether

Potential Future Developments

The introduction of MiCA presents a major challenge for Tether and other stablecoin issuers that do not comply with the new regulatory framework. According to the European Securities and Markets Authority (ESMA), companies must meet MiCA’s requirements by March 31, 2025. Failure to comply will force crypto exchanges to delist non-compliant stablecoins or limit their use within the EU.

If Tether (USDT) fails to align with MiCA regulations, it will inevitably lose market share in Europe, strengthening the position of competitors like USDC, which already meets the new regulatory standards.

While Tether Holdings Ltd. is actively making strategic moves, its efforts are not focused on regulatory alignment in Europe. Instead, the company is expanding operations in more crypto-friendly jurisdictions and diversifying its business model:

- Relocated headquarters from the British Virgin Islands to El Salvador, obtaining a digital asset service provider license under the country’s pro-crypto regulations.

- Expanded into commodity lending, providing credit to firms engaged in raw material trading.

- Built Bitcoin mining data centers in Uruguay.

- Launched the new USDT0 token on Ink Layer 2, a network developed by U.S.-based crypto exchange Kraken.

Tether continues to invest in cutting-edge technologies and expand its services, strengthening its position as a globally dominant yet regulator-independent stablecoin issuer. Rather than competing for European market share, CEO Paolo Ardoino has emphasized Bitcoin investments as Tether’s core strategy, providing a level of insulation from regulatory pressures.

Even if Tether loses a significant portion of the European market to more regulation-compliant competitors, the company is well-positioned to offset these losses by expanding its footprint in Asia, the Middle East, and potentially the U.S.

You might also like: Paolo Ardoino: “Winning Is a Marathon, It’s Not a Sprint”

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.