Trump’s Tariffs and Crypto: PitchBook Weighs the Real Risk Ahead

Trump’s new tariffs may target trade—but crypto could be the collateral damage. PitchBook’s analysis reveals how Bitcoin, stablecoins, and mining face new risks in a shifting global economy.

On this page

- A New Trade War, A New Crypto Puzzle

- What PitchBook Says — When Crypto Is the Subject

- What PitchBook Doesn’t Say — But Strongly Implies

- Volatility, Hesitation, and the Crunch in Crypto VC

- New Geographies, Deregulation, and the Unknowns Ahead

- Three Macro Shifts Crypto Must Prepare For

- Crypto in the New Map of Trade and Trust

For months, speculation swirled. Would Donald Trump, if reelected, bring back the tariff wars that rattled global markets in his first term? In early 2025, the answer came sharply into focus, and it brought more questions than clarity.

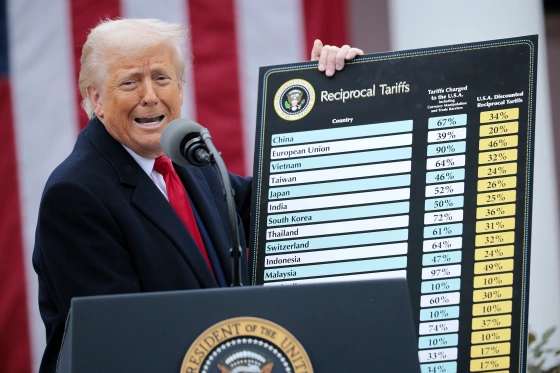

Trump’s new tariff regime landed harder and wider than many expected. And according to PitchBook, one of the most trusted names in private market intelligence, the impact isn’t just about cars or semiconductors. It’s about capital, trust, and yes — crypto.

A New Trade War, A New Crypto Puzzle

Investors had hoped the new tariffs might offer predictability. Instead, they’ve reignited market anxiety. PitchBook’s April 2025 report outlines the knock-on effects: rising inflation risk, disrupted supply chains, and a wave of investor hesitation.

For the crypto market, always sensitive to global volatility, the implications are both direct and subtle. While the term “crypto” appears only briefly in PitchBook’s tariff coverage, the logic of their broader analysis paints a compelling picture: this isn’t just a trade story; it’s a liquidity story, a hardware story, a regulation story.

And PitchBook’s February analyst note, published just as tariff rumors solidified, pulled no punches: crypto is firmly in the blast radius.

What PitchBook Says — When Crypto Is the Subject

In the February report, PitchBook analyst Robert Le focused on hardware-reliant segments like crypto mining and decentralized physical infrastructure (DePIN).

His warning was clear: if tariffs hit Chinese-sourced equipment (especially ASIC chips, which are foundational to Bitcoin mining), then:

- Costs could spike,

- Security could fall,

- Returns could shrink.

Higher hardware or component costs could reduce profitability, potentially leading to higher transaction fees or less network security if hashing power diminishes,

Le wrote.

DePIN projects and hardware wallet manufacturers, often reliant on Asian suppliers, were also flagged as vulnerable.

Beyond hardware, Le also explored investor psychology. In the near term, he predicted a flight to USD-denominated stablecoins like USDC and USDT, seen as safer stores of value in a volatile macro climate.

But long term?

If tariffs and emergency economic measures undermine confidence in US governance,” the report notes, “some investors might shift focus to self-sovereign assets such as Bitcoin.

This duality — stronger dollar now, weaker trust later — is at the heart of how tariffs may shape global crypto strategies.

What PitchBook Doesn’t Say — But Strongly Implies

Volatility, Hesitation, and the Crunch in Crypto VC

The April report, released after tariff details became public, doesn’t name crypto. But the signals are everywhere, and if you know where to look, the extrapolations come into sharp focus.

PitchBook warns of:

- “persistent market volatility”,

- “deal-making hesitation”,

- “capital deployment slowdowns.”

These are red flags not just for traditional VC, but also for crypto venture capital, which has already suffered through a dry spell.

In crypto, many early-stage projects — from layer-2 networks to wallet infrastructure to DeFi protocols — depend on risky capital, often backed by global LPs. If those allocators pull back due to macro uncertainty, the consequences for Web3 could be significant.

New Geographies, Deregulation, and the Unknowns Ahead

There’s also the issue of a geographic capital shift. PitchBook notes that tariffs will push investors to reconsider where they deploy. Countries outside the U.S. tariff scope — in Asia, Europe, and the Middle East — could become new trade and capital zones.

For crypto, this tracks with ongoing migration patterns: developers and companies shifting to more crypto-friendly jurisdictions like Singapore, the UAE, or Switzerland.

Lastly, the April report hints that financial deregulation — part of Trump’s broader economic vision — could unlock new access channels for private market investors. That could be a double-edged sword. On one hand, it might lead to more demand for crypto asset exposure via structured products or ETFs. On the other hand, it could mean more regulatory unpredictability.

Three Macro Shifts Crypto Must Prepare For

- From China to “Crypto Made in USA”

If tariffs persist, especially on Chinese mining equipment, the U.S. could see a revival of domestic mining infrastructure, especially if paired with tax cuts or deregulation. Projects like American Bitcoin Inc, are early indicators of this restoring trend.

But rebuilding supply chains takes time and capital. Small operators may struggle, while well-funded firms could consolidate power.

- From Dollar Dominance to Dual Exposure

In the short term, a strong dollar and inflation fears may boost demand for stablecoins, reinforcing the dollar’s digital twin.

Yet over time, as PitchBook notes, self-sovereign assets like Bitcoin may grow more attractive, especially in emerging markets wary of U.S. protectionism.

It’s a paradox: the stronger the dollar feels today, the more reason some have to hedge against it tomorrow.

- From Capital Abundance to Strategic Scarcity

PitchBook warns of a growing bias toward large asset managers as risk aversion increases.

In crypto, this means tier-one funds will dominate, but niche, agile managers — especially those fluent in trade law, international logistics, or regulatory arbitrage — may find unique advantages.

Funds specializing in “tariff-native” strategies, or those helping startups navigate the new economic terrain, could rise in influence.

Crypto in the New Map of Trade and Trust

In the months ahead, the crypto market won’t just be reacting to CPI data or Fed minutes. It will be responding to how global trade is redrawn and how capital reorients itself across that new map.

PitchBook’s analysis offers no sensationalism, no bold predictions, just patterns, quietly emerging beneath layers of policy and capital movement. But those patterns speak volumes.

If you're a miner, a founder, a fund, or simply someone watching the crypto space from a macro lens, one thing is clear: Trump’s tariffs may be aimed at steel and semiconductors, but their echoes will be heard across the blockchain.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.