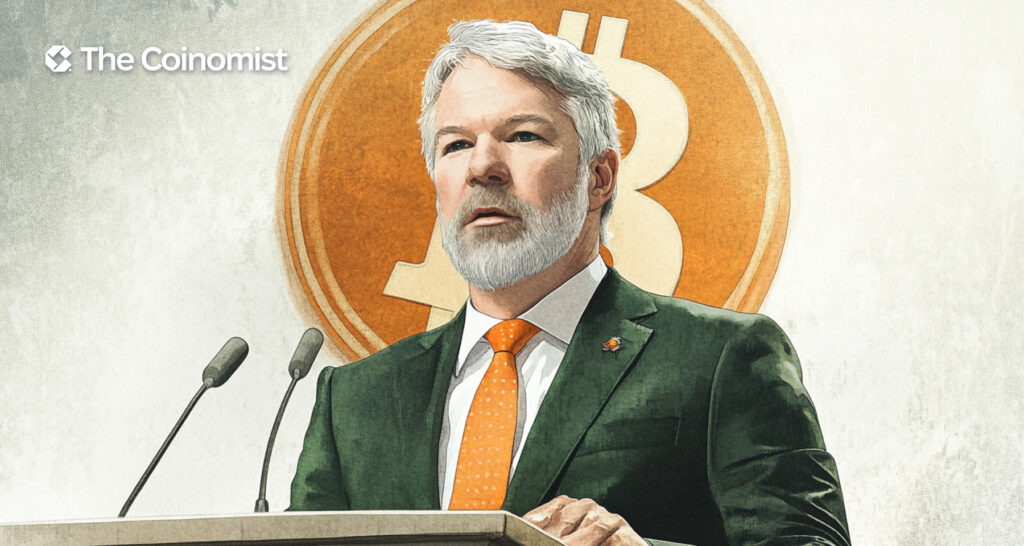

Michael Saylor Goes All In Again: Another $742M in Bitcoin

With its latest purchase of 7,633 BTC at an average price of $97,255 per coin, Strategy has now amassed 478,740 BTC—valued at nearly $47 billion. What’s next for the company?

Michael Saylor, the founder of Strategy, confirmed the latest Bitcoin acquisition. The purchase came just weeks after the company’s rebranding, which included a new name, redesigned logo, and a reaffirmed commitment to Bitcoin-first investment strategy. However, the move also followed a disappointing financial report, revealing a $670.8 million net loss for the last quarter.

Still, Strategy is undeterred. The company’s Bitcoin holdings are deep in the green, with an average acquisition price of just $65,033 per BTC—leaving an unrealized profit of $16 billion. As long as that number stays below the market price, Saylor’s conviction remains unshaken.

Сheck out:MicroStrategy Reports Loss but Holds Firm on Bitcoin Stash Worth Watching

Strategy has set its sights on raising a massive $42 billion over the next two years using special bonds—a move designed to keep its Bitcoin reserves growing.

But not everyone’s buying into the plan. Some analysts warn that if Bitcoin prices take a nosedive, the company could find itself in a financial bind, constantly needing fresh capital just to stay afloat and cover old debts. Will this strategy hold up, or is it built on shaky ground?

Read on: BlackRock Doubles Down on Bitcoin—Boosts Stake in Strategy to 5%

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.