Ripple Enters the UAE Crypto Payments Market

Ripple has obtained full regulatory approval from Dubai’s DFSA, making it the first licensed blockchain-based payment provider in the region.

On this page

Ripple has received approval from the Dubai Financial Services Authority (DFSA) to offer crypto payment services in the UAE. This makes it the first licensed blockchain-based payment provider in the region, granting it access to the UAE’s $40 billion cross-border payments market.

With this approval, Ripple now holds a full DFSA license, allowing it to provide crypto payment and cross-border remittance services within the Dubai International Financial Centre (DIFC), a special economic zone with independent tax and regulatory frameworks.

Arif Amiri, CEO of DIFC Authority, emphasized the importance of this milestone, noting that Ripple is the first blockchain company in the region to receive such approval.

Moreover, Ripple CEO Brad Garlinghouse highlighted the unprecedented growth of the crypto industry, attributing it to increasing regulatory clarity and institutional adoption.

“Thanks to its early leadership in creating a supportive environment for tech and crypto innovation, the UAE is exceptionally well-placed to benefit,” Ripple CEO added.

The Dubai license reinforces Ripple’s presence in the strategically important Middle Eastern market, where demand for digital payment solutions continues to expand.

According to the World Bank, the UAE’s cross-border payments market exceeds $40 billion annually. Ripple notes that regional banks and fintech companies are actively exploring faster international payment solutions, making the UAE a prime destination for expansion.

Related: No Taxes, No Worries—The Best Countries for Crypto Expats

Ripple and the Stablecoin Market

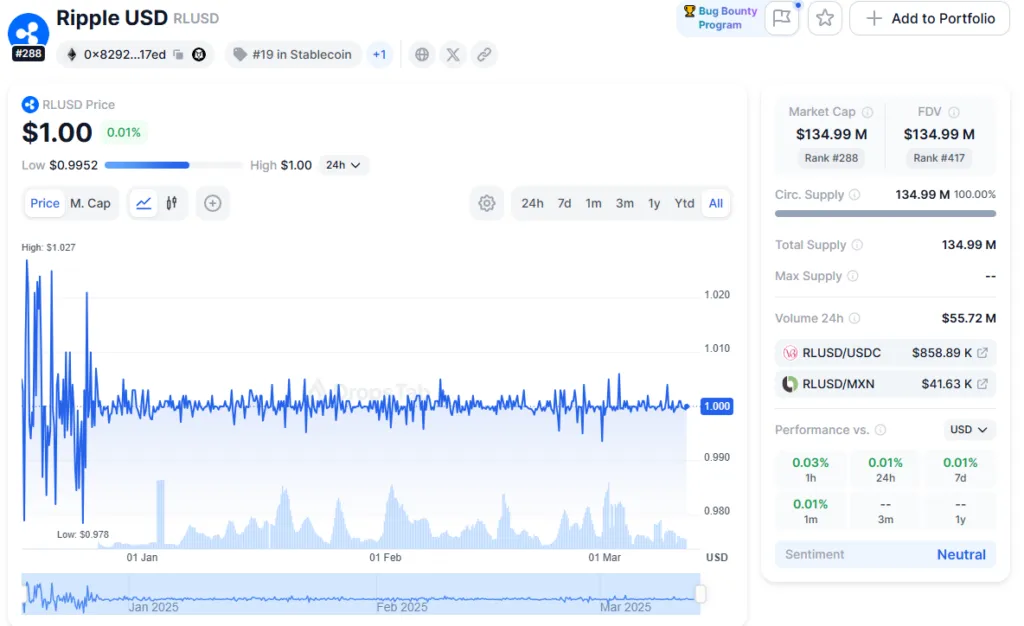

Obtaining this license could also accelerate the adoption of stablecoins in the UAE, as they facilitate instant transactions. In December 2023, Ripple launched its USD-backed stablecoin, RLUSD, which has already reached a market capitalization of $135 million.

Additionally, the company has announced plans to expand global access to RLUSD and is actively working with the Central Bank of the UAE to ensure compliance with upcoming stablecoin regulations in the country.

Ripple has been strengthening its presence in the region for years. Moreover, in 2020, it established its Middle East headquarters in the DIFC, and today, approximately 20% of its global clients operate in this market.

With its new regulatory status in Dubai, Ripple now has even greater opportunities to collaborate with local banks, fintech firms, and government agencies.

The Battle of the Year: Ripple vs. SEC

Ripple’s approval in Dubai comes at a pivotal moment in its ongoing legal battle with the U.S. Securities and Exchange Commission (SEC). The SEC first filed a lawsuit against Ripple in 2020, accusing the company of selling XRP in an unregistered security offering.

Related: Ripple vs SEC: Is This the Final Chapter?

Recent leaks from journalist Eleanor Terrett suggest that the case could soon resolve, with the SEC reportedly easing its stance on the crypto industry.

Following these developments, XRP climbed 2.2% in the past 24 hours, outperforming BTC and other major cryptocurrencies.

What’s Next for Ripple?

The DFSA license positions Ripple for further expansion in the UAE and the broader Middle East market. As a result, the company can now offer its payment solutions to major financial institutions and work toward integrating stablecoins into the real economy.

This move strengthens Ripple’s global presence, adding to its portfolio of over 60 regulatory approvals in key jurisdictions such as Singapore, Ireland, the U.S., and others.

Ripple is betting on the growth of international crypto payments, with the UAE becoming a key market for its expansion.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.