Winklevoss Twins’ Net Worth and Crypto Fortune

Tyler and Cameron Winklevoss are American venture capitalists who became billionaires after investing in Bitcoin. How much are the Winklevoss twins worth, and what are they up to now?

On this page

Who are the Winklevoss twins?

The brothers take immense pride in their self-made journey. They were born into an ordinary American family on August 21, 1981. Their father worked as a business school instructor, and their mother was a homemaker with a keen interest in photography.

Howard Winklevoss with his sons. Source: Instagram

They also had an elder sister, Amanda, who tragically lost her life to a drug overdose in 2002. Amanda grappled with chronic depression, and the twins acknowledge that mental health challenges seem to have run in the Winklevoss family.

Amanda Gesine Winklevoss. Photo from Tyler Winklevoss's personal collection

While they didn't receive a hefty inheritance from their parents, the twins always had a way of capturing attention, and their popularity notably extended into their college years.

Firstly, they are mirror twins, with one being right-handed and the other left-handed, making them inseparable. They've represented the Olympic rowing team and are adept at playing piano duets. This gave rise to jokes that perhaps the Winklevoss brothers were once conjoined twins, successfully separated by surgery.

Tyler and Cameron Winklevoss at the piano. Source: Medium

Secondly, they can read each other's thoughts. Many have observed one starting a sentence and the other finishing it seamlessly.

In their younger years, Tyler and Cameron were notorious for their bold demeanor, leading their peers to cheekily dub them the “Winklevoss brats”. Among other nicknames, they were called “Twinklevoss”, “Winklevii”, and “Testosterone Titans”. Their assertive presence and fashion choices were distinctly masculine.

What were the beginnings of their business journey?

Realizing they didn't have a family fortune to fall back on, the Winklevoss twins knew their path to success lay in forging connections with the upper echelons of society. With ambition driving them, they enrolled in prestigious universities, first at Harvard, which boasts students from the world's most elite financial and political families, and then at Stanford, a hub for the tech visionaries of tomorrow.

Harvard, 2002. Source: Instagram

Their remarkable ambition and athletic accomplishments paved the way. The Winklevoss brothers successfully competed in university (and later Olympic) rowing teams and cultivated “valuable” relationships in the social clubs of these institutions.

The Winklevoss twins pursued rowing until 2010. Source: Forbes

Additionally, from the age of 13, they delved into programming. In 2003, they began working on a social networking website called HarvardConnection. They brought Mark Zuckerberg on board, entrusting him with the code they had crafted to enhance it further. However, in 2004, when Facebook was unveiled, the brothers alleged their code had been appropriated, leading them to file a lawsuit against Zuckerberg.

This legal confrontation persisted for four years and culminated in a settlement agreement. The Winklevoss twins received a hefty compensation of $65 million from Zuckerberg. They specifically requested $45 million of this to be paid in Facebook stocks, which subsequently reaped them an eightfold return.

This substantial sum set the stage for their subsequent flourishing careers.

Their saga inspired the film, “The Social Network”, which turned out to be a top American hit in 2010.

The Winklevoss Twins’ Net Worth

During the lawsuit, Cameron and Tyler launched another platform, “ConnectU”. Although it didn't live up to their aspirations and faded from memory in a couple of years, they also rolled out several ventures under the banner of “The Winklevoss Chang Group”. They became widely recognized as the rowing twins who challenged Zuckerberg.

While they earned a reputation as “patent trolls” during this time, it didn't inhibit the Winklevoss twins from astutely investing their settlement and broadening their entrepreneurial horizons. They founded Winklevoss Capital, a venture capital entity, directing investments into various endeavors including:

- Cabify, a taxi-hailing service;

- Caviar, a premium food delivery service; and

- Square, a pioneering payment processing solution.

Stanford's lessons weren't wasted on the Winklevoss twins: Bitcoin became their ace in the hole.

In 2012, when they delved into the first cryptocurrency, it was valued at just $10 per coin. After acquiring about 120,000 BTC, its price shot up. By 2017, their returns soared over 300,000%, leading to their nickname, the “Winklevoss Crypto Twins”.

Later, in 2015, they ventured into Ethereum and, that same year, established the crypto exchange Gemini, which yields them an impressive annual income of roughly $100 million.

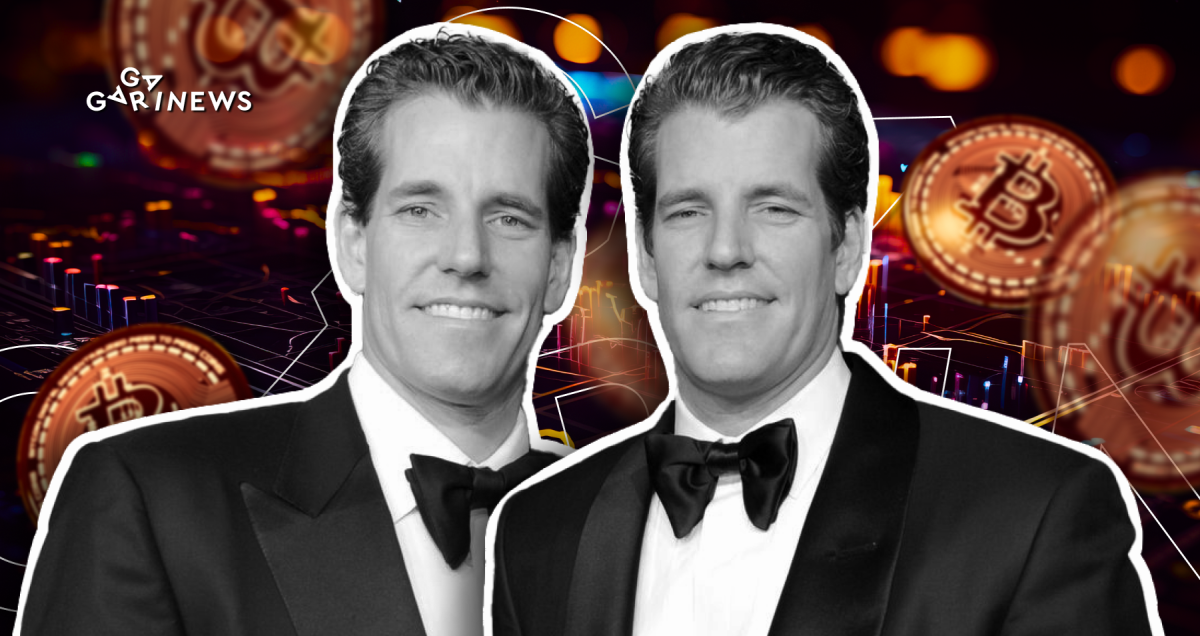

Winklevoss Twins and BTC. Source: bitstat

Now, the Winklevoss twins have amassed a fortune of $4.2 billion. While Cameron and Tyler jointly manage their assets, they acknowledge they don't oversee each other's expenditures. Their instinctual sync, refined over the years, seems to eliminate the need for extra scrutiny. This synchronicity is perhaps best showcased by their ability to increase their net worth from $2.4 billion in 2020 to $4.6 billion in 2022, even in a bear market. Only regulatory challenges in 2023 slightly nudged the duo from their crypto dominance. The winning formula for the Winklevoss twins? Bitcoin + Ethereum + their crypto exchange Gemini.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.