William Quigley, WAX/Tether: Stablecoins’ Role in Global Payments

William Quigley, co-founder of WAX and Tether, firmly believes that stablecoins are more than a tool for traders—they’re the key to transforming the global economy. Already central to crypto trading and cross-border payments, their future potential is even more exciting.

On this page

In a recent interview, Quigley highlighted that in today’s $100 trillion global economy, people spend nearly $1 trillion on fees for transfers and transactions. “1% may not sound like much,” as your university economics professor might say. But that’s $1 trillion that could stay in users' pockets.

He emphasized that stablecoins have the potential to significantly reduce these costs.

Stablecoins as the Foundation of Cryptocurrency Trading

Stablecoins remain essential to cryptocurrency markets, accounting for 60–70% of all trading pairs.

Stablecoins are considered a safe harbor when there’s market volatility

Quigley explained, emphasizing that traders use them to preserve value in uncertain times.

However, their adoption outside trading—for online purchases and peer-to-peer payments—remains limited. Quigley attributes this to insufficient corporate and organizational focus, as well as a lack of regulatory clarity.

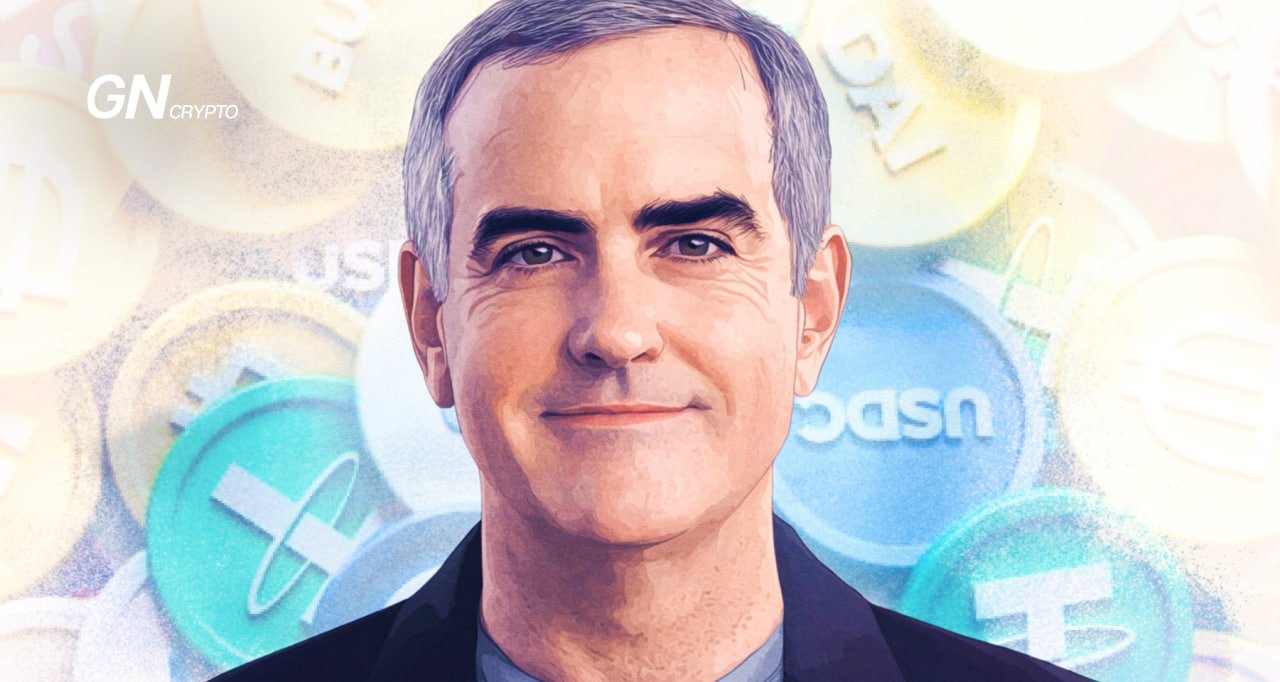

William Quigley, co-founder of WAX and Tether. Source: YouTube

Related: The Future of Stablecoins with MiCA

Institutional Interest in Stablecoins on the Rise

While major financial institutions are beginning to integrate stablecoins, Quigley believes the pace of adoption remains sluggish.

Most non-crypto companies have a very limited understanding of blockchain and its potential

he remarked.

Drawing parallels to the early days of the internet in the 1990s, Quigley noted that many businesses are still skeptical of cryptocurrencies, focusing mainly on trading rather than exploring their use in daily commerce.

Stablecoins hold significant promise for international payments, where they could dramatically reduce costs compared to traditional systems. Quigley highlighted Stripe's recent $1.1 billion acquisition of a stablecoin infrastructure company as a prime example.

Stablecoins could take a trillion dollars of costs out of the hands of financial institutions and put it back into businesses and consumers

Quigley concluded.

Promises of Stablecoin Regulation

Looking ahead to 2025, Quigley expressed optimism about the prospects of stablecoin regulation under the Trump administration. He emphasized the critical need for establishing clear standards, including requirements for 1:1 reserve backing, licensing, and regular audits, to ensure transparency and foster trust in stablecoin systems.

Equally important, Quigley stressed the necessity of creating regulatory frameworks that allow public and private stablecoins to coexist and complement each other.

He also highlighted the untapped potential of stablecoins in reducing currency conversion costs within the global economy.

Stablecoins shine in cross-border transactions by eliminating the need for currency conversion

Quigley said, adding that this innovation could save businesses and consumers billions of dollars annually.

Related: Stablecoins Achieve Historic $200 Billion Market Cap

Resistance and Future Outlook

Despite their undeniable benefits, stablecoins face resistance from institutional players who derive significant profits from currency conversion fees.

Quigley referred to this as an “invisible tax” on global trade—one that stablecoins could effectively eliminate. However, he also highlighted a critical challenge: many policymakers and business leaders lack a deep understanding of stablecoins’ transformative potential. This knowledge gap could slow the development of efficient regulatory frameworks.

As stablecoins evolve, their role in global commerce and finance is expected to expand significantly. With regulatory clarity on the horizon, Quigley is confident that stablecoins have the potential to become one of the most groundbreaking innovations in the monetary system since the advent of fiat currency.

Profile: William Quigley

Often likened to legendary investors like Peter Lynch for his deep understanding of the technologies he invests in, William Quigley has supported over 30 projects tied to Bitcoin, blockchain, and cryptocurrencies, including co-founding Tether.

Quigley began his career at Disney, where he worked in the Disney Store retail division and the Disney Consumer Products department. His role involved collaboration with Disney's licensing unit, the world's largest licensor of consumer products at the time.

In the 1990s, he pivoted toward emerging technologies such as software, e-commerce, and communications. After a tenure at Mid-Atlantic Venture Funds, Quigley joined IdeaLab Capital Partners as Managing Director, a prominent venture capital firm known for backing iconic Web 1.0 projects like PayPal, NetZero, and Mp3.com.

He also co-founded Clearstone Venture Partners, a firm specializing in communication and consumer technologies.

Quigley made his mark in the cryptocurrency industry as one of its most influential investors. In 2013, he co-founded Crypto Currency Partners, a venture capital fund that supported major crypto companies like Coinbase, Kraken, Bitfury, Authy, ChangeTip, and Circle.

William Quigley with laser eyes: a symbol of Bitcoin devotion. Source: Х

In 2015, Quigley launched the Worldwide Asset eXchange (WAX), a blockchain platform that has become a leading marketplace for NFTs.

Quigley is also a longtime gaming enthusiast. He believes that blockchain gaming holds tremendous potential as one of the industry's most promising frontiers.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.