US Treasury Secretary Nominee Reveals Plans to Sell Assets

Scott Bessent is preparing to divest his assets to comply with federal ethics rules. Uncertainty remains about whether his Bitcoin ETFs from BlackRock are included in the sale.

On this page

A week before President-elect Donald Trump’s inauguration, Scott Bessent—a billionaire hedge fund manager and nominee for US Treasury Secretary—announced plans to sell multiple assets, including his stake in BlackRock’s Bitcoin ETF (IBIT).

This decision aligns with federal ethics rules requiring nominees to divest certain holdings within 90 days of Senate confirmation to prevent conflicts of interest.

As Treasury Secretary, Bessent would oversee financial markets, including cryptocurrency regulations. Such a role could present a conflict if he were in a position to influence policies favorable to his personal investments, such as advocating for tax relief or relaxed regulations for crypto companies, potentially increasing the value of his holdings.

Bessent’s intention to liquidate his crypto-related assets was revealed on Saturday, January 11. The announcement was accompanied by an ethics agreement and financial disclosure filed ahead of his Senate confirmation hearings.

Investments Scott Bessent Plans to Divest

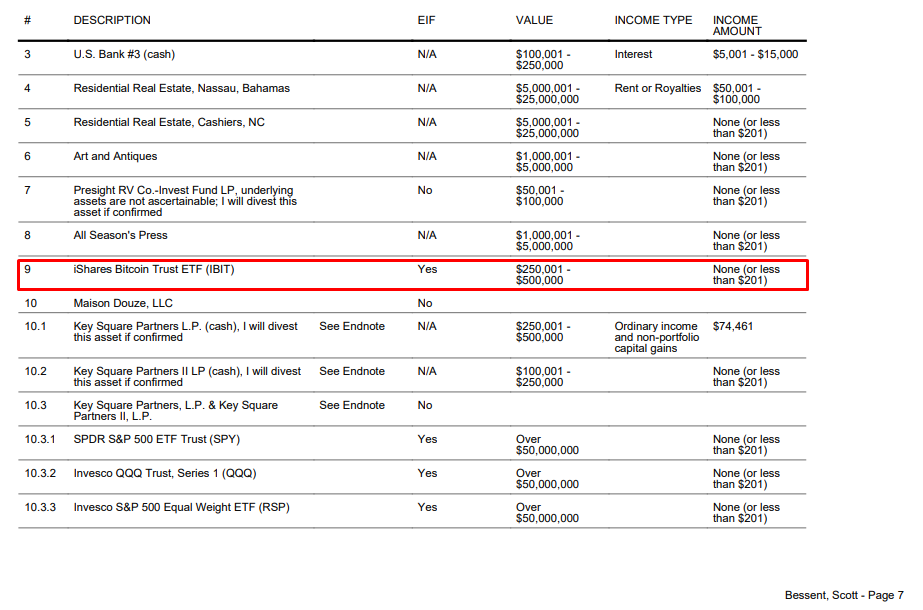

Scott Bessent has disclosed his assets and investments, which include holdings in the iShares Bitcoin Trust ETF (IBIT), valued between $250,000 and $500,000. Other significant investments he plans to divest include a margin account exceeding $50 million at Goldman Sachs, an account for trading Chinese currency, and a stake in the conservative book publishing company, All Seasons.

In a letter to the Office of Government Ethics, Bessent pledged to “avoid any actual or apparent conflicts of interest” if confirmed as Treasury Secretary.

Along with selling these assets, Bessent plans to exit Key Square Group, the hedge fund he founded, by selling his ownership stake in the firm.

Scott Bessent has pledged to divest his assets, but whether the iShares Bitcoin Trust ETF (IBIT) is included remains unclear. The absence of a specific mention of its sale in the IBIT section has sparked speculation, further amplified by a tweet from Matthew Sigel, Head of Research at VanEck, who expressed skepticism about Bessent’s intention to divest his holdings.

Before founding Key Square Group, Bessent was Chief Investment Officer at Soros Fund Management from 2011 to 2015, overseeing the assets of billionaire George Soros and his charitable foundations.

If confirmed as Treasury Secretary, Bessent will have a busy agenda. He has voiced support for tax reform and deregulation and commented in October that the Trump administration is likely to pursue policies aimed at strengthening the dollar as part of its broader economic strategy.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.