5 U.S. States Considering BTC Reserves

The race to establish Bitcoin reserves is gaining momentum in the U.S. While some states are still debating the potential of strategic crypto investments, others are taking concrete steps toward integrating Bitcoin into their state treasuries.

Donald Trump and his political allies are reportedly developing plans to incorporate Bitcoin into the U.S. Treasury's national reserves. Inspired by this trend and fueled by Bitcoin’s rising value, several U.S. states have started exploring similar initiatives.

As of now, five states have proposed creating strategic Bitcoin reserves. Crypto advocates are pushing for broader adoption, urging more states—and even nations—to follow suit.

Here’s a closer look at the states considering adding Bitcoin to their treasuries.

Texas

Texas lawmakers are gearing up to decide whether the state should create a strategic Bitcoin reserve. In December 2024, State Representative Giovanni Capriglione introduced a bill urging the “Lone Star State” to include Bitcoin as part of its financial reserves.

The proposed legislation mandates that Texas hold Bitcoin for a minimum of five years, with the cryptocurrency stored securely in cold wallets—offline devices that protect against cyber threats. Additionally, the bill specifies that these Bitcoin reserves cannot be used for transactions outside the state.

A strategic Bitcoin reserve aligns with Texas’s commitment to fostering innovation in digital assets and providing Texans with enhanced financial security,

the legislation states.

The proposal also invites Texas residents to contribute directly to the Bitcoin reserve through donations. This participatory model would allow citizens to actively support the state’s financial strategy while bolstering regional economic stability.

Pennsylvania

In November 2024, the Pennsylvania House of Representatives proposed a bill to establish a strategic Bitcoin reserve. The legislation would authorize the state treasurer to allocate up to 10% of funds from the State General Fund, Rainy Day Fund, and the State Investment Fund.

Bitcoin, which has appreciated significantly over the years, can help Pennsylvania keep pace with inflation and economic change,

states a legislative memorandum dated November 12.

If enacted, this allocation could enable Pennsylvania to invest approximately $1 billion in Bitcoin, positioning the state as a key player in the growing cryptocurrency market.

Ohio

On December 17, 2024, Ohio State Representative Derek Merrin introduced a bill proposing the creation of a Bitcoin reserve. The legislation seeks to establish a BTC fund within the state treasury and grants the Ohio treasurer the authority to purchase and manage Bitcoin assets.

While the implementation details remain unclear, the bill is expected to lay the groundwork for more extensive initiatives in 2025.

Merrin expressed confidence that this legislation could act as a springboard for Ohio’s adoption of Bitcoin reserves. He emphasized Bitcoin’s transformative potential for the financial system and global economy, arguing that integrating BTC into state financial management would bolster fiscal stability and enhance Ohio’s economic strength.

A prominent advocate for cryptocurrency, Merrin was recognized as a “strong defender of crypto” by the Coinbase-backed organization Stand With Crypto in August 2023.

New Hampshire

On January 10, 2025, New Hampshire State Representative Keith Ammon introduced a bill that would allow the state treasury to invest in Bitcoin. While the legislation doesn’t specifically mention Bitcoin, it is the only cryptocurrency that meets the market capitalization criteria outlined in the proposal.

Ammon explained that while the state remains financially tied to the U.S. dollar, this measure would enable a portion of state funds to be invested in assets that are independent of dollar fluctuations.

The bill also grants the state treasurer authority to engage in lending and staking activities. Ammon cautioned that states delaying the adoption of Bitcoin reserves could find themselves at a competitive disadvantage. He emphasized the importance of rapidly educating government officials to ensure well-informed decisions about Bitcoin-related initiatives.

North Dakota

North Dakota has become the latest U.S. state to explore adding Bitcoin to its balance sheet. On January 10, 2025, state legislators passed Resolution No. 3001, authorizing the allocation of select state funds into digital assets.

The resolution aims to combat inflation’s impact on the state’s finances by diversifying its investment portfolio. While the document does not specify which assets will be included, there is widespread speculation that Bitcoin and other cryptocurrencies will be part of the mix.

North Dakota Legislative Council Director John Bjornson explained that specifics—such as the selection of assets—will be addressed in a future bill.

Discussions about the creation of a Bitcoin reserve in North Dakota are currently on hold but are expected to resume soon. If successful, this initiative could result in a formal proposal, similar to those being developed in other states.

Will the U.S. Create a Bitcoin Reserve?

The idea of establishing a Bitcoin reserve in the United States has gained traction following Donald Trump’s pledge to make America the cryptocurrency capital of the world and begin acquiring BTC for the national reserve. Unsurprisingly, the proposal has generated significant interest among crypto advocates.

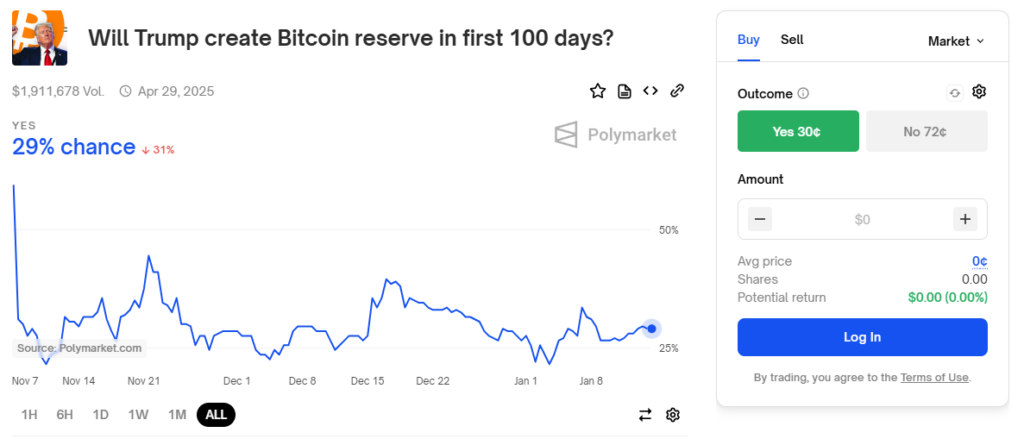

On the betting platform Polymarket, users currently estimate a 29% chance that Trump will create a Bitcoin reserve within his first 100 days in office. This figure has dropped from 45% in November, reflecting increased uncertainty about the practicality of such an initiative.

Experts are divided on the issue. Jack Mallers, CEO of Strike, is optimistic, suggesting that Trump could kick off his presidency by advancing the Bitcoin reserve plan. Meanwhile, Mike Novogratz, CEO of Galaxy Digital, remains skeptical, citing significant legal and political hurdles that could delay or derail the effort.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.