What Is DeFAI? How Is It Different from the DeFi We Know?

AI in crypto is leading to new categories, one of which is DeFAI. From the first guess, you can correctly tell that DeFAI is the combination of decentralized finance (DeFi) and artificial intelligence (AI).

On this page

- AI Memecoins and Bots Sparked a New Trend in Crypto

- What Is DeFAI? A Hot Crypto Narrative Rising from the AI Agent Space

- Zooming Into the Categories of the DeFAI Space

- What’s the Difference Between DeFi and DeFAI?

- Top DeFAI Crypto Projects as of January 2025

- What Are the Challenges of DeFAI?

- Is DeFAI a Hype or the Future of DeFi?

This is a rising category of new crypto projects focused on on-chain automation. According to CoinGecko, as of January 2025, the total market cap of DeFAI coins stands at over $1 billion.

Though this is a small amount compared to the $109 billion market cap of the DeFi sector, many DeFAI tokens are among the top gainers in crypto, making it one of the biggest narratives in the industry.

Follow along to find out what DeFAI is, how it’s different from standard DeFi, and what makes these tokens valuable.

AI Memecoins and Bots Sparked a New Trend in Crypto

The latest AI agent trend in crypto started with AI memecoins. In mid-2024, AI researcher Andrey Ayrey created Truth Terminal, or Terminal of Truths, an AI bot. While experimenting with Truth Terminal, Ayrey set up two LLMs to communicate with one another.

The experiment went crazy, as the systems came up with a new religion.

Truth of Terminal has its X (Twitter) account where Ayrey publishes messages the bot generates – not all of them, but the ones that make sense.

At first, Truth Terminal was not related to crypto, but then an AI memecoins called GOAT was created inspired by the AI. Truth Terminal mentioned GOAT in one of its posts, driving the coin’s price up.

Following this, the hype around AI agents and AI memecoins continued to grow. Agent development and launchpad networks like Virtuals or Fetch.ai came into the spotlight as they allow users to easily create and coordinate their AI agents.

What Is DeFAI? A Hot Crypto Narrative Rising from the AI Agent Space

Developments in the AI + crypto sector keep evolving. New projects appeared that focus on AI agents’ different use cases, including how they can run investment DAOs, manage wallets and portfolios, automate trading, and more.

DeFAI, is just the combo of DeFi and AI, but it opens up a world of possibilities.

DeFi is a very broad concept. It covers pretty much anything you’d do on a blockchain – lending, borrowing, yield farming, sending funds, making swaps, trading derivatives, and so on. It’s the backbone of almost every on-chain interaction.

All this, however, can be complicated for a Web2 user.

And that’s where AI agents come in.

They can handle all those complicated DeFi tasks for you. Being autonomous programs, they can be instructed to move across decentralized networks, make transactions, and interact with different applications.

But AI agents are no regular bots. The difference is that AI agents can learn over time, make decisions, and adapt based on the data they gather. It’s like having a bot that gets smarter the more it works.

In DeFi, this means assessing the market and following a set of rules.

In other words, it’s like having a personal crypto assistant that grows smarter and more efficient the more you use it.

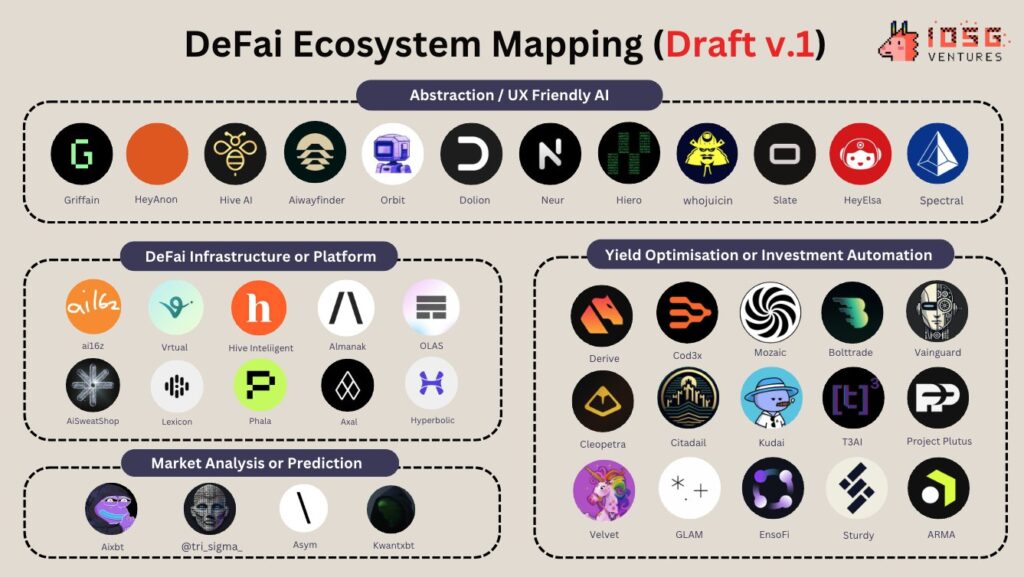

Zooming Into the Categories of the DeFAI Space

AI agents can redefine the user experience for individual DeFi participants. Overall, the DeFAI sector can be divided into the following categories:

- Trading Agents

DeFAI projects focused on trading automation rely on AI for real-time trading signals, research, and automation of repetitive tasks without constant manual work. These agents simplify DeFi activities, making the sector more flexible.

- Governance and Investment Agents

AI agents can optimize collective decision-making processes in decentralized autonomous organizations (DAOs). AI-powered DAOs, like ai16z, are already gaining traction. Based on Solana, the organization uses an AI agent to propose projects for the community to vote on and decide whether to invest or not. ai16z has its native token, $ai16z, which community members use to participate in voting.

3. Abstraction Agents

These DeFi agents are all about keeping things simple and accessible for everyone. They use Web3 tools like bridges and messaging platforms to make life easier for both developers and users. For developers, it means creating apps is a breeze – think text-based instructions instead of complicated coding.

For users, it’s about interacting with DeFi without getting stuck in the messy details. Instead of worrying about complex transactions, abstraction agents handle everything in the background, taking care of on-chain tasks based on what you need – quickly and effortlessly.

Related: What is Chain Abstraction?

4. Asset Management and Yield Optimization Agents

Intelligent agents can help users gain more profit by enhancing their trading strategies. Through analysis and automatic execution, they offer managing risks and maximizing returns for different market conditions. For example, the Cortex platform with its trading agent can access data from sources like X, Arkham, and Dex Screener, find ways to reduce gas and make transactions on any chain.

What’s the Difference Between DeFi and DeFAI?

DeFi, as we know it, is an ecosystem of financial applications built on blockchain networks that operate without intermediaries like banks. These applications use smart contracts to enable users to lend, borrow, trade and earn yields directly.

At its core, DeFi lays the groundwork for blockchain-based finance, while DeFAI takes it further by incorporating AI agents. In addition to simplifying the user experience, DeFAI offers tools to create more efficient and profitable strategies.

The biggest difference lies in accessibility and automation.

DeFi gives you the tools to manage your finances on the blockchain, but it still takes time, knowledge, and effort to get it right. DeFAI steps in to make things easier and more accessible by letting AI agents handle all the heavy lifting.

Related: DeFi vs CeFi

Top DeFAI Crypto Projects as of January 2025

One thing to know about DeFAI or other rising trends in crypto is that there are a growing number of projects, and the ones that are trending at the moment may lose their position later.

Considering DeFAI coins for your investments, AI agent-building frameworks, or multi-agent platforms, keep following the developments.

Top DeFAI coins and platforms currently include:

- Griffain (GRIFFAIN)

Griffain is a network of AI agents built on Solana. Its native token GRIFFAIN is currently the largest DeFAI token with a market cap of over $380 million, according to CoinGecko.

On the platform, users can create their personal agents or use agents created by Griffain for DeFi activities like swapping and finding trendy tokens to trade.

2. Hey Anon (ANON)

Acting as a smart layer for simplified DeFi operations, Hey Anon allows users to execute a trade, view their portfolios, and use agents to handle activities across chains. The AI DeFI protocol uses conversational AI to process user instructions and automate complex DeFi operations.

Hey Anon’s native ANON token can be used for governance, rewards, and agent skills improvements. At the time of writing, ANON trades at around $17 and has a market cap of over $226 million.

3. ORBIT (GRIFT)

Orbit is a finance assistant that connects DeFi protocols and AI agents. The platform allows different agents whether it’s focused on making payments or trade cross-chain, to connect to blockchains and do their jobs quickly and easily.

GRIFT is Orbit’s native utility token, which gives holders access to premium features and rewards. The token’s market cap currently is over $94 million.

4. PAAL AI (PAAL)

Another trending DeFAI project – PAAL AI is an ecosystem focused on custom data feeds and large language models (LLMs). Combining advanced bots with intelligent agents and blockchain provides solutions for different purposes.

For example, Peal Bot can customize data and topics, do research, and provide real-time metrics. A meme agent can browse the latest and most popular memes, distribute content across social media and analyze performance metrics of views.

PAAL tokens can be used for staking, community rewards, and benefits like access to premium tools. PAAL’s market cap currently stands at above $331 million.

What Are the Challenges of DeFAI?

DeFAI has tons of potential, but it’s not without its hurdles. Security is a big one—just like with DeFi, hacks, and exploits are always a threat. There’s also the risk of AI agents being tricked into doing stuff they weren’t supposed to, which could mess with your funds or plans.

On top of that, combining AI and blockchain isn’t exactly simple; it takes some pretty advanced tools to make it work smoothly and safely. Plus, since DeFAI is still new, there’s a lot of uncertainty around how reliable these projects are. If you’re diving in, it’s a good idea to stay informed and tread carefully.

Is DeFAI a Hype or the Future of DeFi?

DeFAI has quickly become a buzzword in the crypto world, sparking debates about whether it’s just another passing trend or the next big evolution of DeFi.

On one hand, the hype around AI agents and their ability to automate complex tasks, optimize strategies, and simplify user experience is undeniable. They offer a level of convenience and efficiency that could make DeFi more accessible to the average user.

But on the other hand, it’s still early days. Many DeFAI projects are experimental, with unproven long-term reliability and potential security risks.

For now, it’s a mix of hype and genuine potential, but utilities like DAO investment and simplified trading are already noticeable.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.