Is Ethereum Dead? Why Ether Struggles to Hit New Highs

The bull cycle that began in November 2024 couldn’t push Ether to a new all-time high. Ether has been underperforming compared to Bitcoin and many other major cryptocurrencies.

On this page

While Bitcoin surged past $100,000, hitting a record of over $109,994 on January 20, 2024, Ether fell short of surpassing its all-time high of $4,890, set back on November 16, 2021.

Will Ether reach new highs in 2025, or will it lose momentum altogether? What’s driving the bearish sentiment around the coin? That’s what we’ll explore in this article.

Ether’s 2024 Underperformance: What Went Wrong

Looking at the numbers, you’ll spot an interesting fact: Ether’s value compared to Bitcoin has declined over the last three years. Since Ethereum moved from the Proof of Work consensus mechanism to Proof of Stake during the Merge event in September 2022, the ETH/BTC ratio has been down.

According to TradingView, the ETH/BTC price is currently around 0.031, marking a decline of about 50% since 2022. This metric reflects how many Bitcoins are needed to buy 1 Ether and indicates investors' focus and demand for different cryptocurrencies.

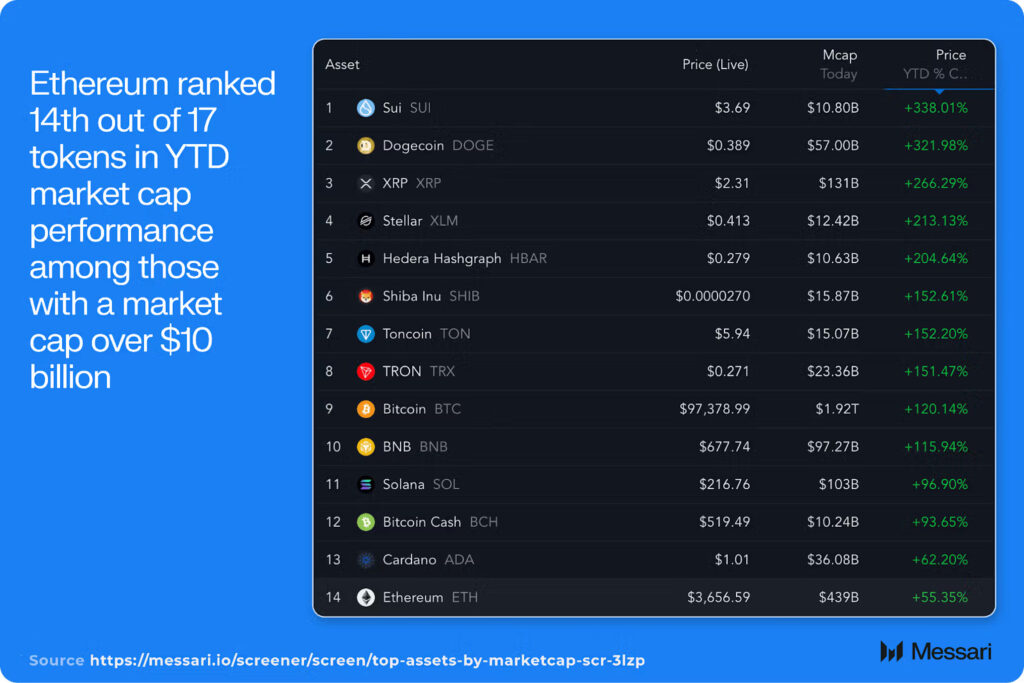

Moreover, in terms of market cap growth, Ethereum fell behind other large cryptocurrencies in 2024. According to Messari Research, it ranked 14th, coming after Sui, Dogecoin, XRP, Stellar, and others.

This decline in growth has left many wondering: is Ethereum dead?

What are the main concerns around the network? Here’s a breakdown:

- Strong Competition from Other Networks

In 2024, the competition between Ethereum and other networks got stronger. In particular, Solana had a breakout year, positioning itself as the main platform for memecoins and AI-driven projects, and surpassing Ethereum in total fees generated.

Overall, as pointed out by asset management firm VanEck, Ethereum’s share of blockchain fees has dropped from 86% in 2022 to just 33% in 2024. Its dominance in decentralized exchange (DEX) volumes has also taken a hit, falling from 42% to 29%.

At the same time, the consistent growth of Layer 2 solutions like Base and Arbitrum presents a challenge, as it indicates that activity on Ethereum’s main chain is declining.

- Slow Speed of Transactions and High Gas Fees

Ethereum has long faced criticism for its relatively slow transaction speeds and high gas fees. Currently, the network processes around 13 to 15 transactions per second (TPS), which is a far cry from its biggest competitor, Solana, which can handle up to 65,000 TPS. This stark difference in speed highlights one of Ethereum’s most significant challenges, particularly as the demand for transactions and decentralized applications (dApps) continues to grow.

Related: Vitalik Buterin Targets 100,000 TPS in Ethereum’s Evolution

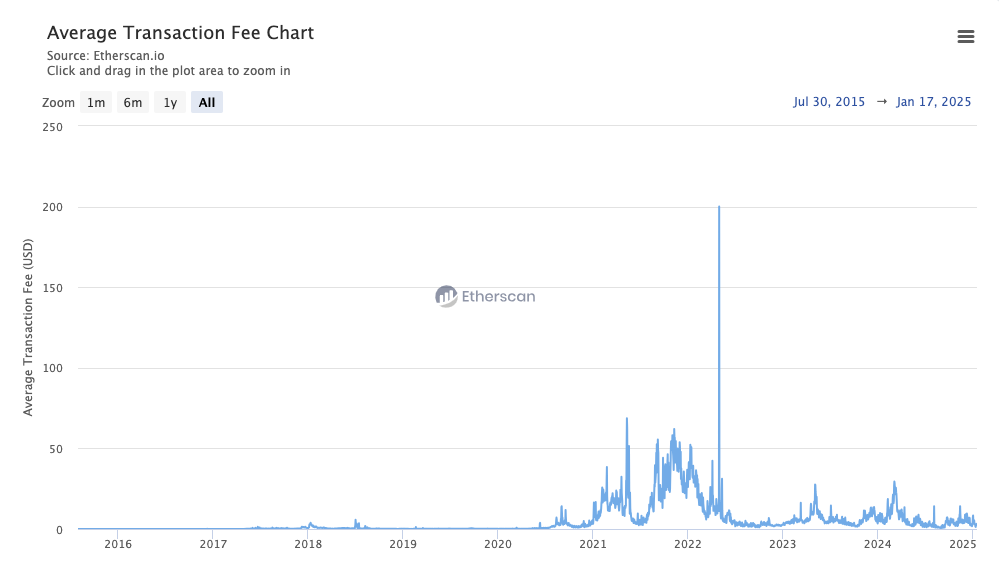

The issue with slow speeds is compounded by high gas fees. On Ethereum, the average cost for a transaction can reach several dollars—around $3 at the time of writing. In contrast, Solana offers transaction fees that are a fraction of a cent, making it a much more affordable option for users, particularly in the world of decentralized finance (DeFi) and NFTs, where frequent transactions are common.

Network congestion can further exacerbate Ethereum’s gas fee problem. When the network is busy, fees can spike dramatically. In some cases, transaction costs have been known to exceed $10 or even $20.

However, Ethereum is actively working to address these issues. Due to technical upgrades and Layer 2 scalability solutions, the blockchain’s transactions now are cheaper and faster compared to previous years.

3. Limited Adoption of Ethereum ETFs

In July 2024, the US Securities and Exchange Commission (SEC) gave the green light to spot Ethereum ETFs.

As ETFs are investment funds that trade on stock exchanges, it was expected that institutional adoption of Ether would grow.

But things didn’t quite take off the way people hoped. Ethereum ETFs didn’t see the same buzz as Bitcoin ETFs. In fact, there were some pretty big outflows—like over $159 million on January 8, 2025.

That said, the trend seems to be shifting. Since mid-January 2025, ETH ETFs have been gaining momentum. Their total net inflows are now sitting at over $2.6 billion. For comparison, Bitcoin ETFs are still far ahead, with more than $38 billion in total net inflows.

Related: Crypto ETNs vs Crypto ETFs: Understanding the Differences

4. Centralization Issues

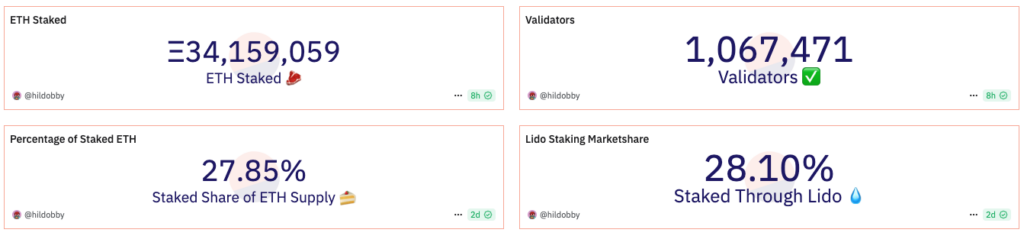

After the Merge, there have been worries about decentralization because to be a network validator, you need to stake 32 ETH. That’s a lot, so staking power might end up in the hands of just a few big players like staking pools and exchanges.

Data from Dune Analytics shows Lido controls 28%, Coinbase 9.6%, and Binance 6.3% of the staking amount.

Liquid stakers like Lido let users stake ETH without locking it up, giving them stETH tokens that still earn rewards but can be used or traded.

So, big stakes could have too much influence on Ethereum’s governance, making it more centralized. But on the bright side, there are over a million validators right now, which increases decentralization.

Another concern is that Layer 2s carry their own centralization risks when they rely on a small number of validators or sequencers to process and order transactions.

If Layer 2 solutions are too centralized, they might be vulnerable to manipulation or censorship by the controlling parties.

Ethereum’s Achievements You Can’t Deny

Despite the challenges, Ethereum continues to be the largest smart contract platform. According to DeFiLlama, currently, it’s the top chain by Total Value Locked (TVL) of over 65 billion.

This is not without a reason. The network is mature and has a diverse ecosystem. The majority of stablecoins, DeFi, dApps, and development are on Ethereum.

One of the key reasons for Ethereum’s success is its ability to attract major institutions. Big players like Visa and Sony are increasingly turning to Ethereum to build cutting-edge solutions. In September 2024, Visa announced development of the Visa Tokenized Asset Platform (VTAP) on Ethereum, a solution that enables banks to issue and manage fiat-backed tokens.

In January 2025, PlayStation maker Sony launched its Ethereum Layer 2 platform, Soneium focused on the games and the entertainment industry.

The adoption of Ethereum by industry giants like Visa and Sony demonstrates its reliability and versatility. It can support everything from financial tokenization to next-generation gaming platforms.

The Final Question: Is Ethereum Dead, or Will We See New All-Time Highs in 2025?

Given everything going on with Ethereum, it’s clear that despite existing issues, it is at least far from being dead.

Moreover, Ethereum is not standing still. It’s moving forward.

Further proposals and upgrades are expected to make the network faster, cheaper, and more decentralized. The upcoming Pectra upgrade, scheduled for March 2025, is supposed to improve user experience, transaction processing, and development flexibility.

Ethereum’s long-term roadmap and possible upgrades like BeamChain aim to improve scalability and reduce entry barriers for validators.

Along with this, there’s high interest in investments from the largest Ethereum holders, including asset managers BlackRock, Fidelity, and US President Donald Trump.

So, it doesn’t look like Ethereum will go out of competition anytime soon, but the competition with newer blockchains is getting stronger and stronger.

What about the price?

It depends on a few things – market sentiment, technological progress, adoption rates, regulatory developments, competition from other blockchains, and global economic trends.

Ethereum supporters argue that the coin is currently undervalued and will reach new highs this year. Based on 4-year price patterns from 2017 and 2021, Ether could reach $8,000 this year.

Anyway, there’s a lot of uncertainty, and right now, Ether is riding a wave of both excitement and skepticism.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.