Deribit Hits $1.1 Trillion in Trading Volume in 2024

On January 22, 2025, Deribit, a leading cryptocurrency derivatives exchange, released its annual report, highlighting record-breaking trading volumes and open interest milestones.

On this page

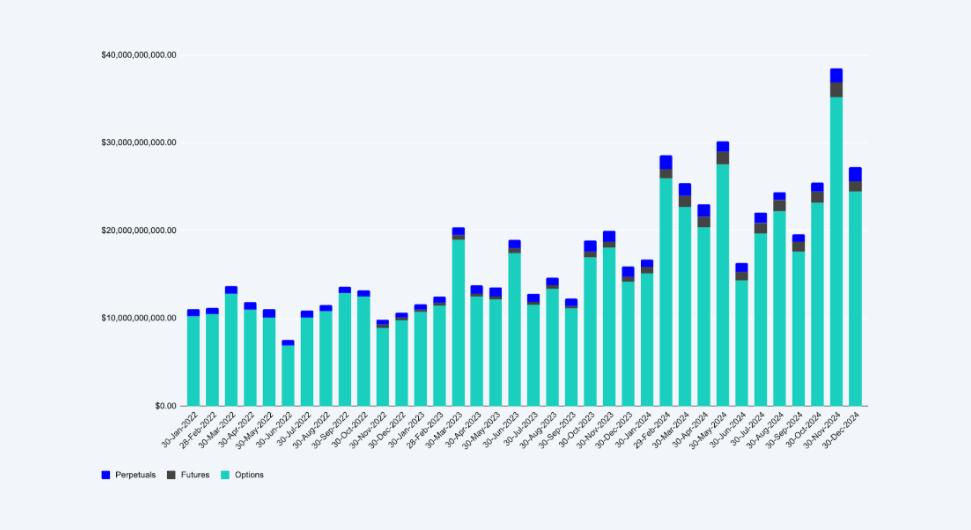

In 2024, Deribit achieved a staggering $1.1 trillion in trading volume, up from $608 billion in 2023—a 95% year-over-year increase, according to the company’s annual report.

The exchange experienced a sharp rise in activity throughout the year, particularly in Q4, driven by institutional investor optimism surrounding the U.S. presidential election and Bitcoin’s rally to $100,000.

The highest daily trading volume was recorded on November 12, 2024, shortly after the election of pro-crypto candidate Donald Trump, reaching $14.8 billion. Open interest—the total value of outstanding futures and options contracts—also hit a record high of $48 billion on November 28, fueled by Bitcoin’s price surge.

Deribit achieved exceptional growth in 2024, not only increasing its overall trading volume by 95% but also recording a significant surge in options trading. Over the year, options trading volumes rose by 99%, with $243 billion traded in Q4 alone.

The most dramatic gains came from spot trading—a division Deribit began developing only in 2023. Spot trading volumes skyrocketed by an incredible 810%, jumping from $837 million in 2023 to $7.6 billion in 2024.

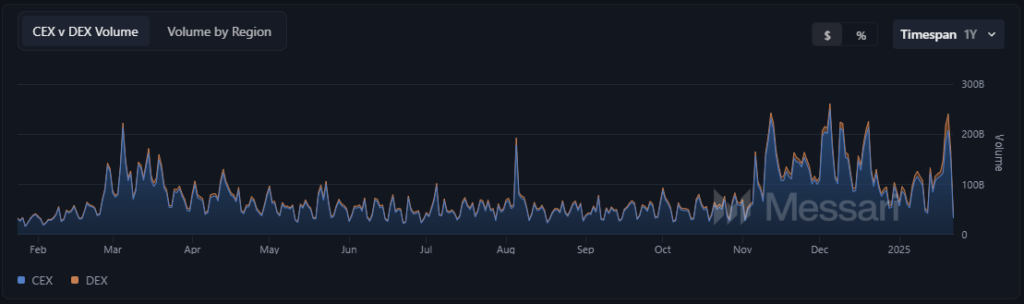

Deribit wasn’t the only exchange to capitalize on the year’s bullish market conditions. Several catalysts fueled the surge in trading activity during 2024, including the launch of Bitcoin and Ethereum ETFs, the growing hype around memecoins, and the central role of cryptocurrency in the U.S. presidential elections.

For many exchanges, December 2024 was the strongest month for trading volumes since November 2021, signaling a robust recovery from the extended bear market.

Deribit’s impressive growth in 2024 was closely aligned with its commitment to strengthening regulatory compliance. The exchange secured authorization from Dubai’s Virtual Asset Regulatory Authority (VARA) and is actively pursuing derivatives trading licenses in France and Brazil.

In its efforts to combat money laundering, Deribit adopted the FATF’s “Travel Rule,” implementing mandatory Know Your Customer (KYC) protocols and rigorous compliance checks.

Deribit also made significant advancements in its asset custody solutions. The exchange introduced hybrid systems in partnership with Fidelity, Zodia, and Copper, allowing users to leverage third-party custodial services. Additionally, Deribit integrated Fireblocks Off Exchange to enhance security and flexibility for institutional and retail clients alike.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.