AI16Z, VIRTUAL, SWARMS Fall by Half — Is Recovery Possible?

Recent days have brought heavy losses to AI agent tokens, with prices falling sharply amid a broader crypto correction. Could this create new opportunities for savvy traders?

On this page

Over the last week, AI agent tokens have faced notable declines, while Bitcoin remained stable in a period of consolidation without major price shifts.

The $AI16Z token, which supports the DAO venture fund and the Eliza OS agent framework, experienced a 50% drop in value. From January 7 to January 13, its price fell from $2.38 to $1.04, leaving it with a current market cap of $1.1 billion.

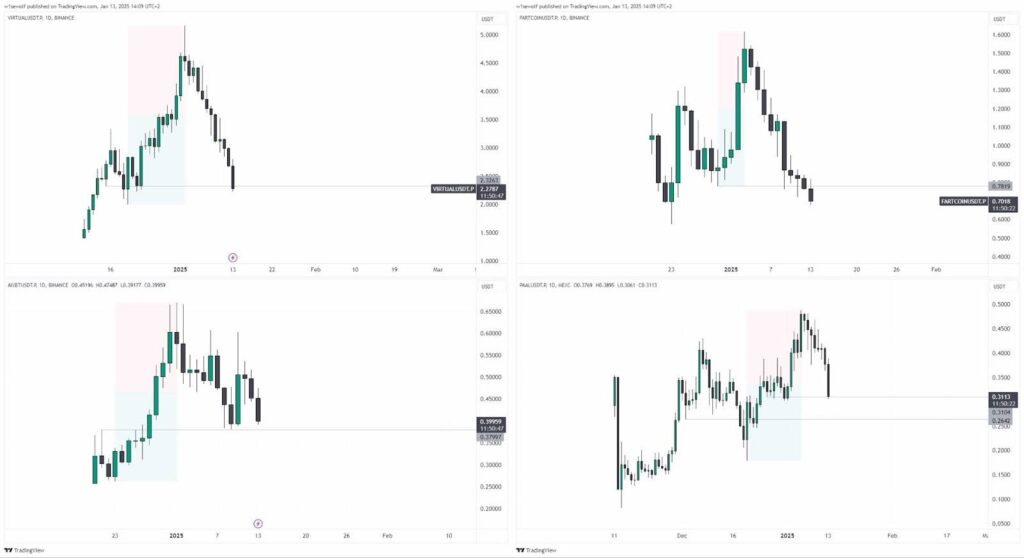

In the same timeframe, $VIRTUAL, a token powering the Virtuals protocol for decentralized AI assistants, saw its value decrease by 44%. Starting at $4.10 on January 3, it now trades at $2.28, with a market capitalization of $2.3 billion.

The Swarms framework token saw a significant 55% drop in price, sliding from $0.50 to $0.20 over the week. This reduction brought its market valuation down to $200 million.

This price drop may reflect the overall market trend, where small adjustments in BTC prices often cause pronounced volatility among altcoins.

Smaller-cap tokens such as $AI16Z and $VIRTUAL are acutely affected by changes in BTC-driven market sentiment. With insufficient buyer-side liquidity, these assets can experience steep declines under even minor selling pressure.

Curious about buyer and seller interplay? Check out: “What is a Footprint Chart and How to Read It?”

This movement might also signal a routine correction. Investors who bought in early frequently lock in gains at local highs, displacing late participants and enabling accumulation at more attractive price levels.

Overheated markets often exhibit this kind of behavior, with growth detached from underlying fundamentals.

What’s the outlook for AI tokens?

The future of AI tokens will rely on several critical elements. If the AI sector continues to captivate attention and projects deliver technological progress while expanding their user base, the market could experience another surge. Recovery is expected to begin with tokens backed by strong ecosystems and proven use cases.

On the technical side, most AI token charts demonstrate a similar trend: prices are testing significant support zones within the 1–0.5 Fibonacci retracement range, which is widely considered an ideal accumulation point for long-term positions.

Community reactions to the recent AI token price swings have been notably calm, at least judging by discussions on crypto Twitter.

Many traders view the dip as a necessary correction, framing it as a chance to accumulate rather than a cause for concern. They’re watching charts carefully for signals of buying strength, aiming to re-enter the market with renewed confidence.

The humor hasn’t gone unnoticed: one user sarcastically advised others to sell during the dip, only to repurchase at a higher price later.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.