Bitcoin Falls Below $100K as Ethereum and Solana Tumble Further

BTC’s value fell to $99,100 in the past 24 hours, a 5.7% decrease from its previous price. Ethereum slid below $3,100, now trading at $3,065 after an 8.2% drop. Solana, with the biggest losses, plummeted 10% to $230.

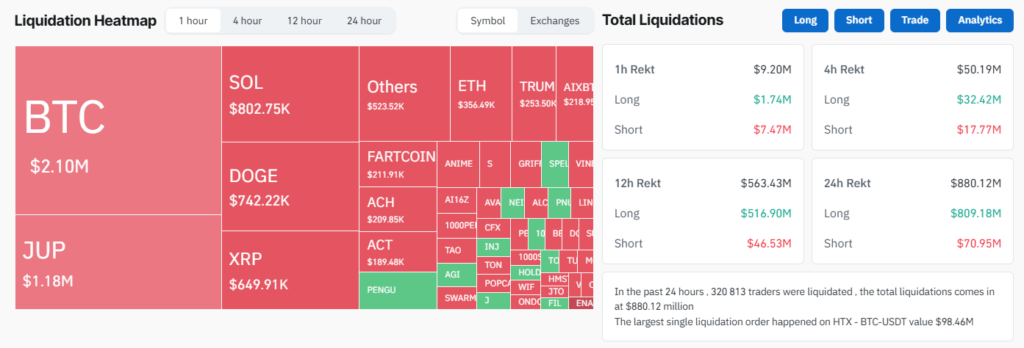

Coinglass reports that crypto liquidations exceeded $880 million in the past 24 hours, disproportionately affecting long positions.

The crypto market turmoil coincided with a 7% premarket slump in Nvidia’s shares. With a market capitalization of $3.1 trillion, Nvidia ranks as the world’s third-largest chipmaker.

The sell-off was sparked by Chinese startup DeepSeek’s announcement of its new AI model, DeepSeek R1. The model is reportedly comparable in performance to advanced technologies from OpenAI and Meta, yet it boasts lower operational costs and reduced computational requirements. This revelation led to a sharp decline in tech-sector stocks.

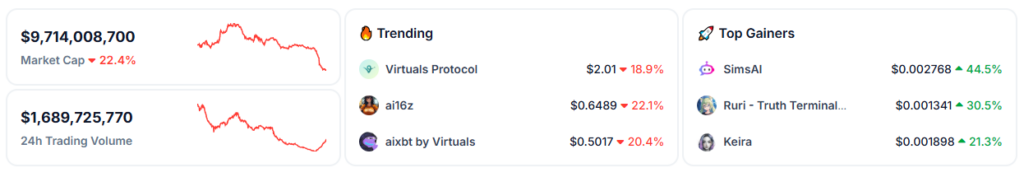

How AI Tokens and Meme Coins Responded to BTC’s Crash

The recent BTC slump hit AI tokens particularly hard, slashing their combined market capitalization by 20% in 24 hours. Fartcoin saw the sharpest decline, losing 23%, while Virtuals Protocol dropped 21%. Other prominent tokens, such as ai16z, AIXBT, and AI Rig, also faced significant setbacks.

Meme coins experienced a tough 24 hours, shedding an average of 11% in market value. Pepe and SPX6900 dropped by 16%, while Dogecoin recorded an 11% decline.

Trump-linked tokens also felt the pressure. TRUMP, which hit a record high of $70 on January 19, tumbled 17% over the past day, now trading at $25.5. This marks a nearly 170% loss from its peak, with its fully diluted valuation (FDV) now at $25.5 billion.

Arthur Hayes, the co-founder of BitMEX, added his voice to market speculation with a new prediction. He warned that BTC’s price might drop to $70,000–$75,000 in the short term, citing a “mini financial crisis” as the likely catalyst.

Yet, Hayes is still bullish in the long run. He forecasts Bitcoin reaching $250,000 by year-end, driven by the anticipated return of accommodative monetary policies.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.