CEX Trading Volume Hits All-Time High: New Report Reveals

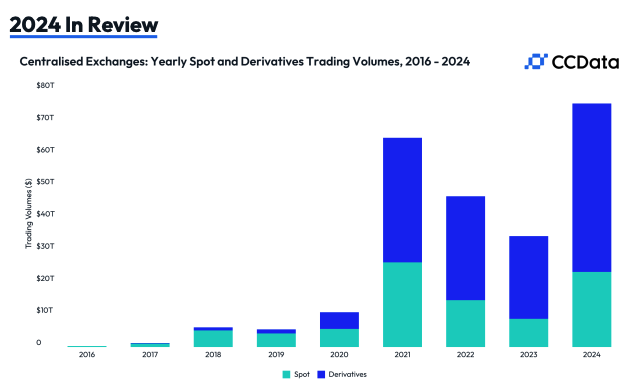

According to a new report by crypto data provider CCData, monthly trading volume on centralized exchanges (CEXs) hit a new all-time high in December 2024.

On this page

The combined spot and derivatives trading volume reached $11.3 trillion, an increase of 7.58%.

Monthly spot trading volume rose by 8.10% to $3.73 trillion, surpassing the previous all-time high recorded in May 2021. Derivatives trading volume was up by 7.33%, reaching $7.58 trillion, marking the third consecutive monthly increase in derivatives volume.

Despite the rise in trading volume, the market share of derivatives trading continued to decline, hitting its lowest point since June 2022. This suggests that traders are becoming more cautious.

CCData notes that the increased activity on CEXs coincided with digital assets remaining volatile following Bitcoin’s new all-time high of $108,000.

After the surge, Bitcoin and other cryptocurrencies experienced a correction. At the time of writing, Bitcoin is trading at approximately $98,700, and the total crypto market cap is above $3.46 trillion.

The report states that as of December 2024, Binance remained the dominant centralized exchange, with a combined spot and derivatives market share totaling 35.1%. In December, the exchange’s trading volume exceeded $946 billion.

Bybit and OKX followed, with market shares of 12.8% and 12.4%, respectively. Bitget and Coinbase rounded out the top five exchanges, with combined market shares of 10.5% and 5.43%, respectively.

Despite Binance’s dominance, its market share is declining, representing the lowest level since January 2021. This signals strong competition among centralized exchanges.

Finally, CCData noted that in January 2025, trading volume on CEXs began to drop, recording around $2.7 trillion in the first 12 days.

This decline may be related to positive economic reports hinting at reduced rate cuts this year, as well as the U.S. Department of Justice selling $6.5 billion worth of Bitcoin seized from the Silk Road darknet marketplace, which has increased caution among investors.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.