CME Group Secures the No.1 Spot in Forbes’ Cryptoexchange Ranking

Forbes has released its latest ranking of the top cryptocurrency exchanges, the Forbes Best Crypto Exchange, evaluating more than 200 platforms to determine the most secure and efficient options for traders.

On this page

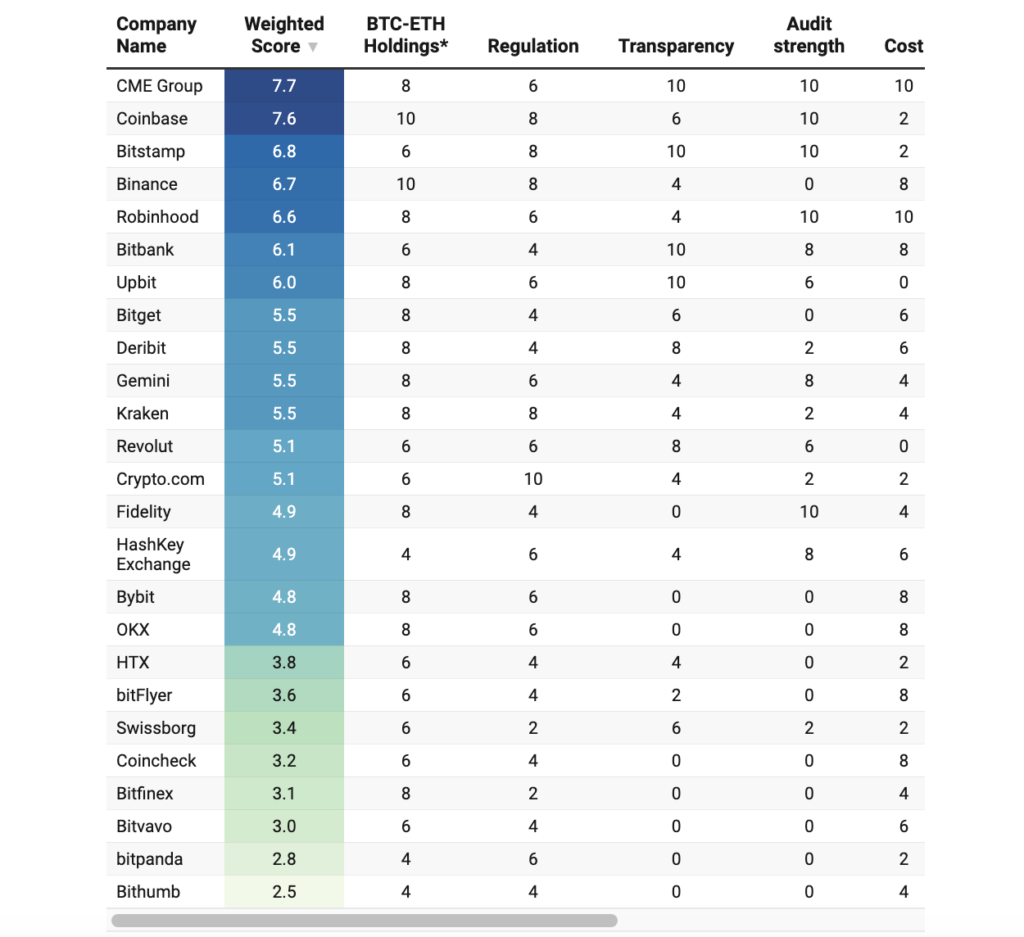

The rankings were built on multiple performance indicators, such as BTC/ETH holdings, regulatory oversight, transparency, audit integrity, institutional user base, trading activity, and cost efficiency (spreads/fees). These factors shaped the final list.

At the top of the rankings is CME Group, a Chicago-based commodities exchange valued at around $85 billion. Despite not being a traditional crypto exchange—and rarely discussed in crypto circles—it earned the highest scores for transparency, regulatory compliance, institutional clientele, and auditing standards. Unlike other platforms, CME exclusively offers futures trading, yet it outperformed the competition in these critical areas.

Coinbase secured the second spot, holding the title of the largest Bitcoin custodian with 11% of all BTC, valued at over $300 billion, primarily due to custody agreements with spot Bitcoin ETF issuers. While highly rated for its regulatory standing and BTC/ETH reserves, it was penalized for its high retail trading fees.

Despite its dominance in trading volume and widespread adoption, Binance ranked only fourth in Forbes’ latest assessment, losing out to Bitstamp. The main weaknesses? Concerns over transparency and auditing. Even so, the exchange scored well in key areas like trading fees, liquidity, and compliance with regulations.

Bybit, OKX, and HTX —Popular, but Lacking Transparency

Bybit continues to expand its user base with competitive fees and aggressive promotions. However, it ranked only 16th in the Forbes list due to poor transparency, the absence of an audit, and a lack of institutional clients. OKX and HTX (formerly Huobi) faced similar challenges and ended up in the same ranking tier.

Bybit has obtained licenses in the Netherlands, Turkey, and Canada, but at least a third of its considerable 26 million visitors come from the Russian-Ukraine war zone, a region subject to US sanctions,

Forbes notes.

Crypto Rankings Across Korea, Japan, and Europe—Where’s WhiteBIT?

The list included two major South Korean exchanges—Upbit, which performed well at 7th place, and Bithumb, which finished dead last.

Among the three Japanese platforms ranked, only Bitbank reached a respectable 6th place thanks to its solid audit and transparency ratings, while the rest struggled in multiple categories.

European exchanges fared no better. Beyond Bitstamp and the Revolut app (which doesn’t function like a standard crypto exchange), Bitvavo and Bitpanda ended up near the bottom due to poor scores in transparency, auditing, and regulatory oversight.

Oddly enough, WhiteBIT—one of Europe’s largest crypto platforms with over $2.7 trillion in annual trading volume—was nowhere to be found in the ranking, raising questions about the selection process.

Like it or not, Forbes estimates that the ranked crypto exchanges collectively hold $1.2 trillion in user assets and attract 438 million monthly visitors. 160 million of them come from the Asia-Pacific region, while 134 million are based in Europe.

Whether skeptics agree with the selection or not, the ranking will serve as a benchmark for many when choosing a trading platform.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.