ETH Dives Below $3,000 — What’s Disrupting the Crypto Market?

The new week starts with turbulence in the crypto market. On Monday, January 13, both BTC and ETH momentarily slipped below crucial levels of $90,000 and $3,000, though minor rebounds followed.

On this page

The downturn in the AI agent token market has been severe, with certain tokens plummeting by over 50% within the week.

According to CoinGlass, traders endured over $700 million in liquidations in just a single day, making the market’s decline particularly harsh.

Source: WhiteBIT

Why is the crypto market experiencing such shocks? The answer may lie in macroeconomic data and broader liquidity forecasts for the crypto sector heading into 2025.

On Friday, January 10, reports highlighted a stronger-than-expected U.S. labor market in December. Non-farm employment surged, surpassing projections, while unemployment dipped from 4.2% to 4.1%.

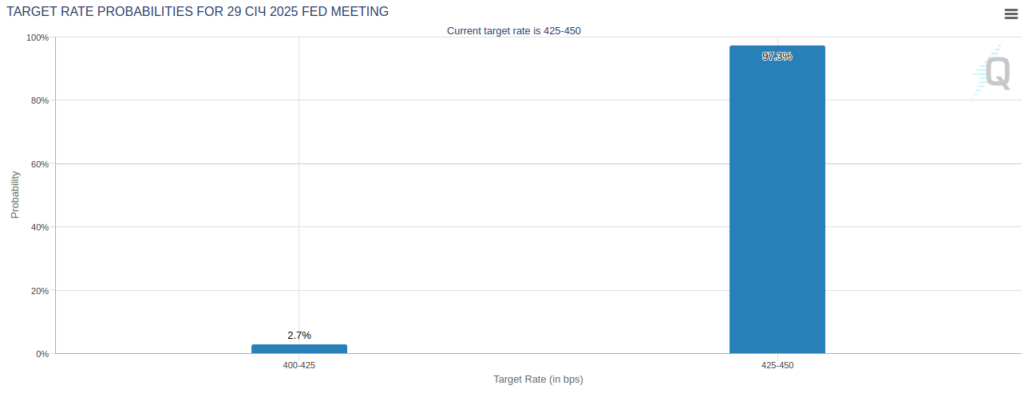

Concerns are mounting that the Federal Reserve could keep its interest rate steady for the foreseeable future. The CME FedWatch Tool currently indicates a 90% probability that the target rate will stay in the range of 425–450 basis points through January 2025.

Source: cmegroup.com

That said, these expectations remain fluid and could shift depending on upcoming economic developments. Keeping tabs on fresh data and the Fed’s broader considerations is highly recommended.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.