JPMorgan — Bitcoin’s Market Behavior Reflects Tech Sector Trends

Bitcoin’s price swings aren’t happening in isolation. JPMorgan analysts have identified a compelling correlation between the world’s largest cryptocurrency and the Russell 2000 Index, which tracks 2,000 of the smallest tech-driven public companies in the U.S.

On this page

According to experts, this isn’t just coincidence—it’s a reflection of broader market trends, shifting risk assessments, and the growing role of retail traders, many of whom rely on margin trading to amplify their positions.

Bitcoin’s relationship with the Russell 2000 Index isn’t always stable, but JPMorgan analysts say it heats up when markets shift. Case in point? Last year’s tech sector revival—Bitcoin’s movements closely mirrored the index. A few years back, though, in a bearish cycle, crypto dropped alongside traditional markets.

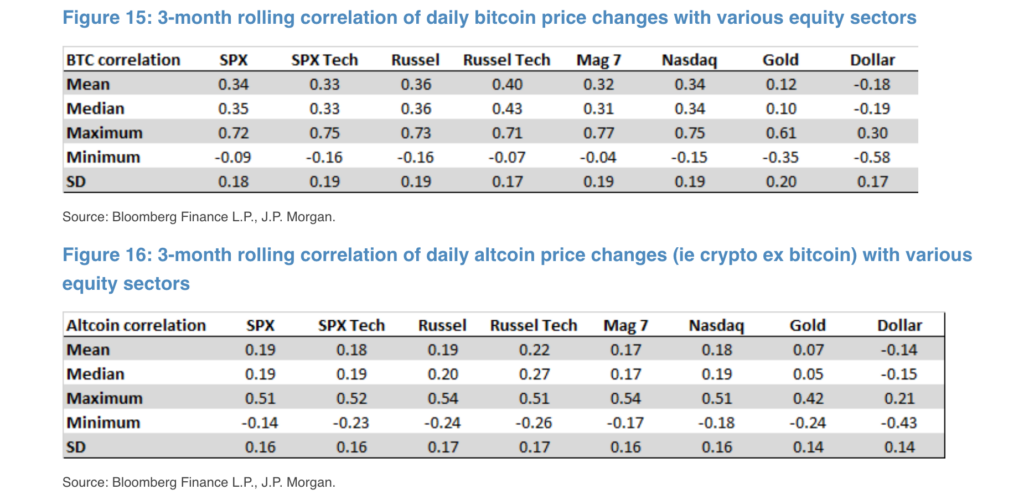

This is true with both bitcoin and altcoins (i.e., crypto ex-bitcoin), although the correlation is on average higher with the former,

the report reads.

Bitcoin might be marketed as the future of decentralized finance, but its price moves tell a different story. According to JPMorgan analysts, Bitcoin is far more entwined with the tech sector than with traditional hedging assets like gold or bonds. When tech booms, Bitcoin follows—when it crashes, crypto takes the hit.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.