Justin Sun Declines to Address Questions About USDD 2.0

Justin Sun has stated he will no longer respond to queries about USDD 2.0’s 20% yield. Despite promises of transparency, the project has faced criticism over its reliance on TRX and insufficient protections for coin holders.

On this page

Tron founder Justin Sun has drawn a line in the sand, announcing that he will no longer field questions about the future of USDD, his algorithmic stablecoin. On January 16, 2025, Sun posted on X asking the community to refrain from further inquiries about USDD 2.0 and its promised 20% annual yield.

He emphasized that the decision to launch USDD 2.0 was straightforward, rooted in Tron DAO’s financial capacity to support it. Sun urged users to stop questioning the yield’s source and trust the project’s viability.

USDD, introduced in 2022, was launched as a direct competitor to UST, the stablecoin that collapsed during Terra’s implosion. Backed by Tron’s native token, TRX, USDD is reportedly governed by Tron DAO.

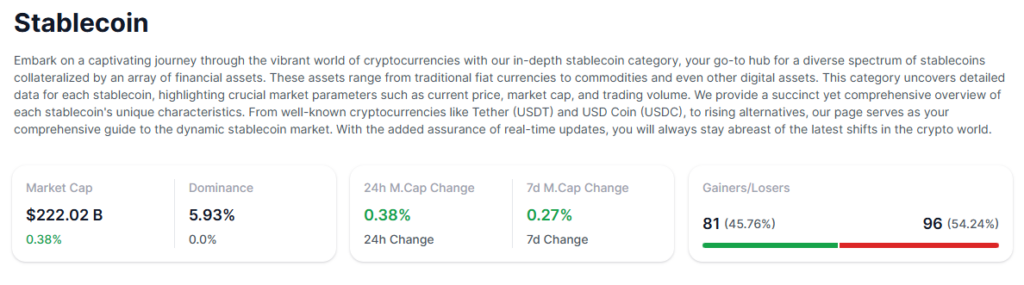

Stablecoins continue to gain momentum across cryptocurrency markets, traditional finance, and commerce as companies vie for a share of this rapidly growing sector. The market for U.S. dollar-pegged stablecoins backed by cash or equivalents, like USDC and USDT, has now surpassed $220 billion in value.

In contrast, the market for algorithmic and crypto-backed stablecoins currently has a total supply of approximately $13 billion, with Tron’s USDD accounting for $747 million in circulating supply.

Criticism of the USDD Stablecoin

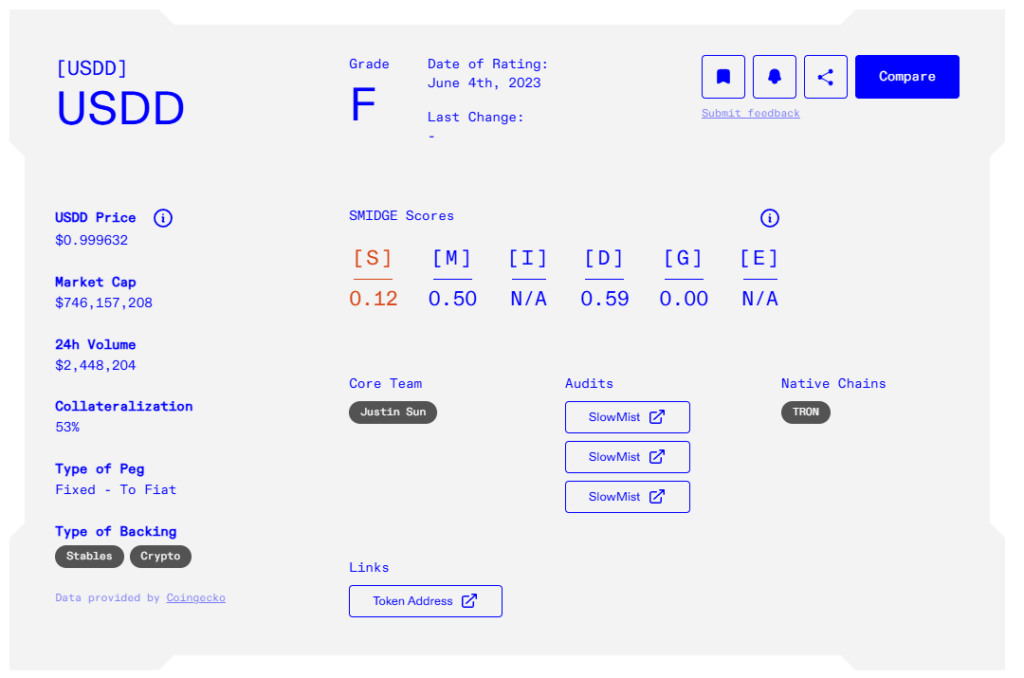

USDD has faced criticism from analysts and market observers. Last year, Bluechip, a company branding itself as the “Moody’s of stablecoins” (providing ratings for stablecoins similar to how Moody’s rates companies and debt instruments), gave the stablecoin its lowest stability rating.

The low rating was driven by USDD’s heavy reliance on TRX as its backing asset and a lack of transparency in its governance and safeguards.

Critics have highlighted the absence of a clear governance framework, leaving USDD holders without legal or technical protections. Instead, they are entirely dependent on reserves controlled by Tron DAO. This reliance presents significant risks, as the stablecoin could be vulnerable to disruptions within the Tron ecosystem.

According to the official website, USDD is backed by a reserve of major digital assets, including TRX and USDT. The total value of these collateral assets exceeds the circulating value of USDD, with a collateralization ratio set at 120%. This means that for every $1 of USDD issued, $1.20 worth of digital assets are held as collateral.

However, despite this over-collateralization, a significant portion of the reserve is made up of TRX tokens, raising concerns about USDD’s stability in the face of potential volatility in the cryptocurrency market.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.