NBIM Expands Indirect Bitcoin Holdings to $356.7 Million

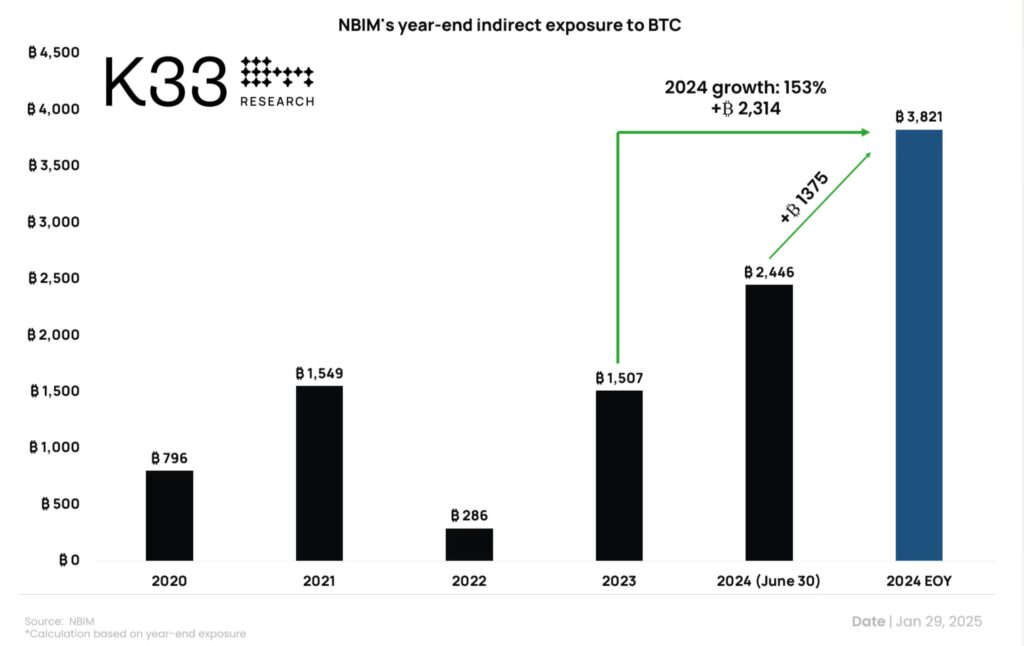

Norges Bank Investment Management (NBIM), managing Norway’s Government Pension Fund, has significantly expanded its indirect Bitcoin exposure, reaching $356.7 million by the end of 2024. According to K33 Research, this represents a 153% increase from the previous year, highlighting a growing institutional appetite for digital assets.

On this page

By the end of 2024, NBIM’s exposure to Bitcoin had surged, with assets tied to 3,821 BTC—a dramatic increase from 1,507 BTC in 2023 and 796 BTC in 2020. This rise is attributed to the fund’s growing stake in public companies with Bitcoin holdings or active roles in the crypto market.

Understanding Indirect Bitcoin Exposure

When an investor has indirect exposure to Bitcoin, they aren’t holding BTC themselves. Instead, they own stakes in companies that have integrated Bitcoin into their business models—either by keeping it as a treasury asset or operating within the crypto industry.

The performance of these companies is closely linked to Bitcoin’s price fluctuations, making them a potential profit driver—or risk factor—for investors tracking the crypto market.

NBIM’s Expanding Crypto Exposure

The Government Pension Fund of Norway, managed by NBIM, has made significant investments in companies deeply embedded in the digital asset space:

- MicroStrategy (MSTR) – 0.72% stake (~$500 million value);

- Tesla (TSLA) – 1.1%;

- Coinbase (COIN), Metaplanet (3350), and MARA Holdings (MARA);

With these investments, NBIM further strengthens its indirect exposure to Bitcoin, as the performance of these companies remains intrinsically tied to the crypto market’s highs and lows.

Source: coindesk.com

AI Revolution Outshines Crypto in NBIM’s Record Profits

Despite its rising crypto exposure, NBIM’s historic $222.4 billion profit in 2024 was primarily fueled by a surge in artificial intelligence (AI) investments.

As Vetle Lunde of K33 Research notes, Bitcoin-related stocks are gaining weight in NBIM’s portfolio as their value climbs—solidifying Bitcoin’s influence in the fund’s overall investment approach.

The expanding institutional acceptance of Bitcoin and blockchain-driven companies underscores the evolving dynamic between legacy finance and digital assets, with NBIM’s strategy reflecting this deepening integration.

The restructuring of Norges Bank Investment Management’s holdings is emblematic of a larger shift, where Bitcoin is no longer just an alternative asset but a long-term strategic pillar for institutional investors.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.