Trump Launches Crypto Task Force and Blocks CBDC Development

U.S. President Donald Trump has made a pivotal move that could reshape the crypto industry. With a new executive order, he seeks to reinforce America’s dominance in the cryptocurrency sector while banning the creation of a central bank digital currency (CBDC).

On this page

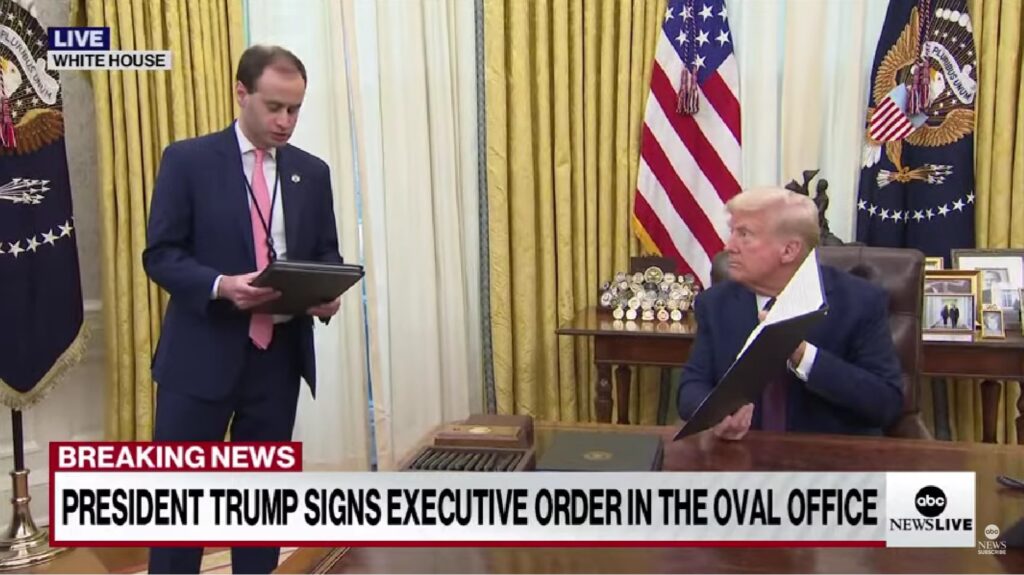

The President delivered the announcement during a televised address from the Oval Office, joined by David Sacks, introduced as his “AI and Crypto Czar.”

Main Provisions of the Executive Order

The signed order establishes a task force under Sacks’s guidance, tasked with creating strategies to crown the U.S. as the “global capital of cryptocurrency.”

Among the members of the task force will be the U.S. Treasury Secretary, the Attorney General, the chairpersons of the SEC and CFTC, and a range of other high-ranking officials.

Essential Points of the New Executive Order:

- CBDC Development Halted: All federal agencies are ordered to cease activities related to the development of a central bank digital currency.

- Strategic Digital Asset Reserve: The newly established task force will explore the possibility of creating a national reserve of digital assets to secure the U.S.’s crypto dominance.

- Stablecoin Regulation: The order emphasizes drafting a comprehensive regulatory framework for stablecoins to enhance clarity and ensure market stability.

Source: ABC News

David Sacks highlighted the order’s intent, emphasizing its focus on fostering private sector investments in crypto while ensuring neutrality in technological developments to mitigate political friction.

Trump Reverses Biden’s Crypto Directive

Trump’s new order nullifies Joe Biden’s March 9, 2022, directive, which was designed to create a regulatory framework for cryptocurrencies.

This pivot underscores Trump’s commitment to pro-crypto policies, aligning with his election platform to promote innovation and advance a more favorable environment for emerging technologies.

Mixed Reactions Emerge

The initiative has garnered widespread support within the crypto industry, but Bitcoin proponents have expressed disappointment over the executive order’s failure to acknowledge BTC by name.

Popular podcaster Peter McCormack criticized this exclusion, noting:

The executive order does not mention “Bitcoin” once.

This omission stands in stark contrast to Trump’s promise at last year’s Nashville Bitcoin conference to create a “national Bitcoin reserve,” financed by over $20 billion in DOJ-confiscated funds.

The inclusion of the broad term “digital assets” in the executive order has ignited discussion within the crypto community.

Dennis Porter, CEO of the Satoshi Action Fund, defended the wording, explaining that it avoids creating unnecessary political polarization.

This neutral framing not only paves the way for more comprehensive discussions about Bitcoin but also establishes a solid basis for a lasting and coherent U.S. cryptocurrency policy.

Porter took it to X:

Tech neutral language such as ‘digital assets’ is a proven and effective way to get to the end goal of making the USA the largest holder of Bitcoin in the world.

The Road Ahead — Positioning the U.S. as a Crypto Powerhouse

Trump’s executive order reflects his vision of making the United States a leader in cryptocurrency innovation, though key issues remain unanswered. Analysts argue that defining the goals of the strategic reserve and ensuring transparency in regulations are essential to gaining investor trust.

The ban on CBDCs, coupled with an emphasis on private initiatives, signals a move away from centralized control. Meanwhile, the attention to stablecoin regulation points to a balanced approach—ensuring market stability without stifling growth.

With David Sacks at the helm, the administration seeks to harmonize innovation in the crypto space with the need to safeguard national security. Concrete proposals to define the future of U.S. cryptocurrency regulation are anticipated in the near future.

What It Means for the Crypto Industry

For the cryptocurrency sector, the executive order represents both opportunities and obstacles.

Decentralization supporters see the CBDC ban as a notable victory. However, the broad and ambiguous term “digital assets” invites differing perspectives and potential regulatory ambiguity.

“Trump is undeniably setting the foundation for a new chapter in the regulation of cryptocurrencies. The industry is cautiously optimistic for now, awaiting more detailed guidance from the U.S. administration,” concludes Ivan Dikalenko, an analyst at The Coinomist.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.