How to Withdraw Bitcoin from PayPal: A Step-by-Step Guide

PayPal is one of the most popular online payment platforms. In 2022, it introduced features that allow users to transact with cryptocurrencies, including Bitcoin (BTC). However, withdrawing crypto from PayPal is not as straightforward as transferring fiat funds. This guide will walk you through the process of withdrawing Bitcoin from PayPal.

On this page

- Why Use PayPal?

- How to Withdraw Bitcoin from PayPal?

- Step 1: Prepare Your Bitcoin Wallet Address

- Step 2: Log In to Your PayPal Account

- Step 3: Navigate to the Crypto Section and Select Bitcoin

- Step 4: Transfer Bitcoin to an External Wallet

- Step 5: Verify Transaction Details and Complete the Withdrawal

- PayPal Fees: What You Need to Know About Withdrawing Bitcoin

Why Use PayPal?

PayPal serves as a secure intermediary, connecting users to their bank accounts or credit cards. Its advanced encryption ensures that all payment and transfer information remains safe, making transactions both secure and reliable.

One of PayPal's greatest strengths is its global reach. Trusted by millions of individuals and businesses worldwide, the platform is recognized for its reliability and ease of use. It also offers valuable features, such as buyer protection, which allows users to recover their money in cases of fraud.

PayPal further enhances security with advanced measures like two-factor authentication and end-to-end encryption, ensuring your financial data remains safe. Instead of entering credit card details on every website, you can simply use your PayPal email address, reducing the risk of exposing sensitive information.

Despite growing competition, PayPal continues to be one of the most popular and convenient platforms for online payments.

How to Withdraw Bitcoin from PayPal?

In 2022, PayPal launched the ability to buy, sell, and hold cryptocurrencies, providing traders and crypto enthusiasts with greater flexibility in managing their assets. However, PayPal representatives have emphasized that the platform was never designed to support full-fledged trading or cold storage of digital assets and has no plans to implement such features.

PayPal’s President and CEO, Alex Chriss, stated that the company’s goal is to use cryptocurrency to enhance its payment infrastructure, not to compete with exchanges like Coinbase or Robinhood.

If you’re using PayPal as a payment gateway for cryptocurrencies, it’s essential to know that direct BTC withdrawals to external wallets are not supported. Currently, users can only store cryptocurrency in their PayPal account or convert it to fiat currency.

To withdraw Bitcoin from PayPal, just follow these simple steps:

- Convert crypto to fiat. The first step is to sell your Bitcoin on PayPal, converting it into fiat currency such as USD or EUR.

- Transfer funds to your bank account. After converting your Bitcoin, you can transfer the fiat funds to your linked bank account using PayPal’s standard withdrawal process.

- Use third-party platforms. If you prefer to withdraw funds as cryptocurrency, you’ll need to use third-party platforms like crypto exchanges or peer-to-peer services. These platforms allow you to transfer funds from your PayPal account to a cryptocurrency wallet.

Here’s a step-by-step guide to withdrawing Bitcoin from PayPal.

Step 1: Prepare Your Bitcoin Wallet Address

To start the process of withdrawing Bitcoin from PayPal, you’ll need to copy the deposit address of your Bitcoin wallet. You can obtain this address from a cryptocurrency exchange or a non-custodial wallet such as Trust Wallet.

- Open your cryptocurrency wallet app.

- Go to the Bitcoin section.

- Tap the “Receive” button to generate your wallet’s deposit address.

- Copy the address or scan the QR code for added simplicity.

Source: coinapult

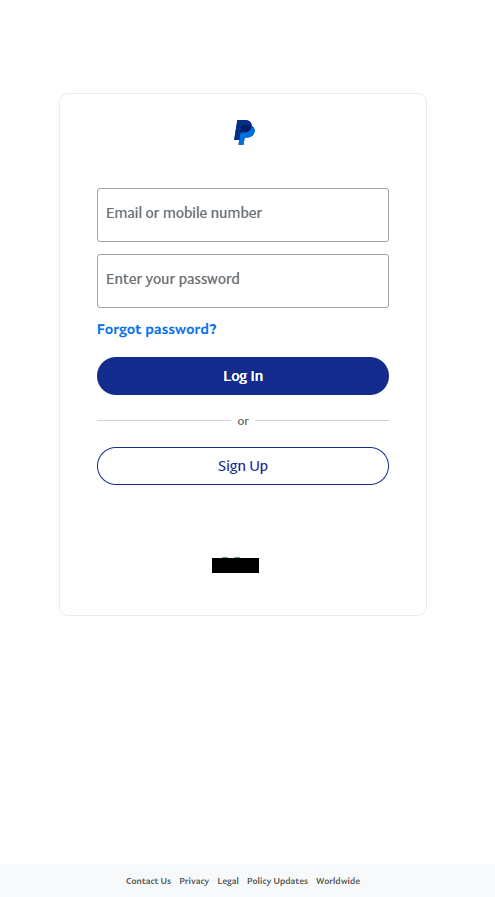

Step 2: Log In to Your PayPal Account

Once you have your Bitcoin wallet deposit address, the next step is to log in to your PayPal account:

- Go to paypal.com.

- Click the “Log In” button in the top-right corner.

- Enter your email address and password.

- Use two-factor authentication to verify your login for added security.

Step 3: Navigate to the Crypto Section and Select Bitcoin

After logging in, go to the cryptocurrency section of your account:

- Locate and click on the Crypto section.

- From there, select Bitcoin (BTC).

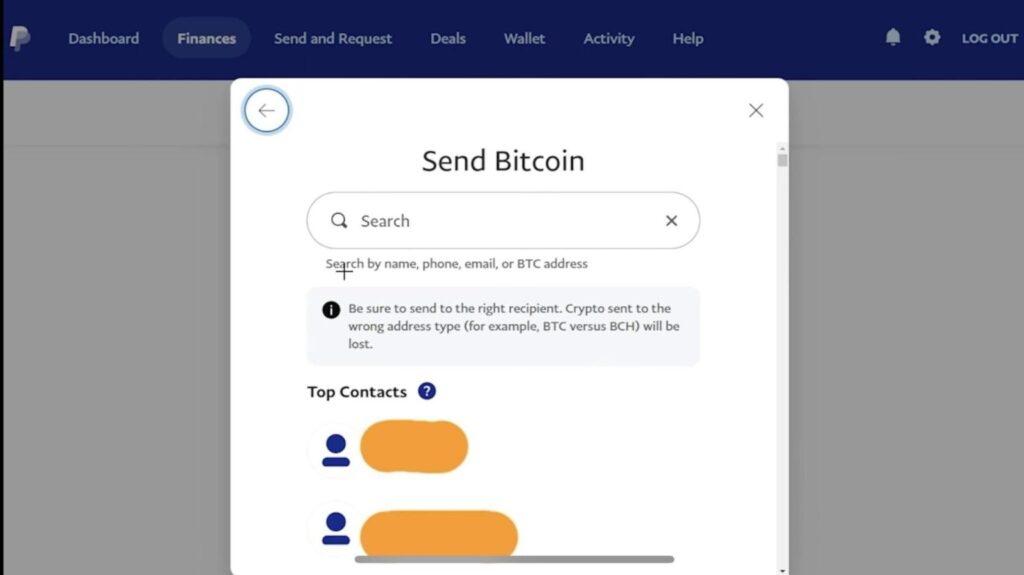

Step 4: Transfer Bitcoin to an External Wallet

Now that you’ve selected Bitcoin, you can proceed with the transfer:

- Click the “Send” button, usually represented by two arrows.

- Paste the wallet deposit address you copied in Step 1.

- If you prefer to send BTC to another PayPal user rather than an external wallet, select the recipient from your contact list.

Step 5: Verify Transaction Details and Complete the Withdrawal

At this stage, it’s essential to ensure all transaction details are accurate:

- Double-check the recipient’s Bitcoin wallet address to confirm it is correct.

- Enter the amount of Bitcoin you wish to transfer.

- Click the “Send Now” button to finalize the transaction.

Once submitted, your transaction will be processed, and the Bitcoin will be sent to the designated wallet address.

PayPal Fees: What You Need to Know About Withdrawing Bitcoin

While creating and maintaining a PayPal account is free for most users, there are fees associated with cryptocurrency transactions. These include charges for commercial activities, transferring cryptocurrency, and other related operations.

In this section, we’ll outline the key types of fees to consider when using PayPal for crypto transactions.

1. Goods and Services Fees (GnS)

When you send money for commercial purposes, such as purchasing goods or services, PayPal charges a transaction fee. This fee typically ranges from 2% to 5%, depending on the recipient’s country and the transaction amount.

Unlike personal transfers, commercial transactions are eligible for buyer protection. If issues arise, such as undelivered items or fraud, PayPal may refund the sender if the transaction is disputed. This makes PayPal a secure option for commercial transfers, but it’s important to note that in some cases, fees can reach up to 9%.

2. Personal Transfer Fees

For personal transfers (e.g., sending money to friends or family), PayPal does not charge fees for domestic transactions. However, this type of transfer does not include buyer protection since it is not for commercial purposes.

For international personal transfers, additional fees may apply if a funding method other than PayPal balance is used, such as a credit or debit card. These fees typically range from 0.5% to 1%.

Since personal transfers are not covered by buyer protection, it’s essential to verify the recipient’s trustworthiness before sending money.

3. Cryptocurrency Transaction Fees

PayPal allows users to buy, sell, and store cryptocurrencies, but there are several important details to consider.

PayPal typically does not charge direct fees for buying or selling cryptocurrency on its platform. However, the exchange rate may be slightly below the market rate due to an added margin. When transferring cryptocurrency from PayPal to an external wallet or exchange, a network fee is applied. This is a standard fee paid to network validators for processing and confirming transactions. Importantly, PayPal’s network fees are significantly lower compared to other platforms, making cryptocurrency withdrawals more cost-effective.

If you plan to use PayPal for cryptocurrency trading or storage, make sure to review the platform’s current fees and network charges, as they may vary depending on your country, transaction amount, and the specific cryptocurrency being used.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.