Utah Legislature Advances Bill to Invest Public Funds in Crypto

Lawmakers in Utah’s House Economic Development Committee have endorsed a bill that would permit the state to allocate part of its treasury funds to cryptocurrency investments.

On this page

Securing an 8-1 majority, HB 230: Blockchain and Digital Innovation Amendments passed its committee hearing on January 28. The bill now heads to the full Utah House of Representatives for further deliberation.

Utah Bill Proposes State-Backed Crypto Investments

Filed on January 21, 2025, by Representative Jordan Teuscher, the bill aims to incorporate digital assets into the state’s investment portfolio.

If enacted, it would permit the Utah State Treasurer to allocate up to 5% of specific government funds into qualified digital assets.

Eligible investments must meet stringent benchmarks, requiring either a market cap surpassing $500 billion or approval as a stablecoin.

Between January 21 and the day of the vote, the bill was amended to introduce zoning regulations for cryptocurrency mining, aimed at managing and structuring the sector’s development within the state.

If both the House of Representatives and the Senate pass the legislation, it will go to Governor Spencer Cox for final approval.

Unless the governor chooses to veto, the law will go into effect on May 7, 2025.

The Rise of State-Sanctioned Crypto Investments

Utah is part of a growing wave of U.S. states considering cryptocurrency as a legitimate investment for public funds. Legislative efforts in Arizona and Wyoming signal a broader movement toward crypto adoption at the state level.

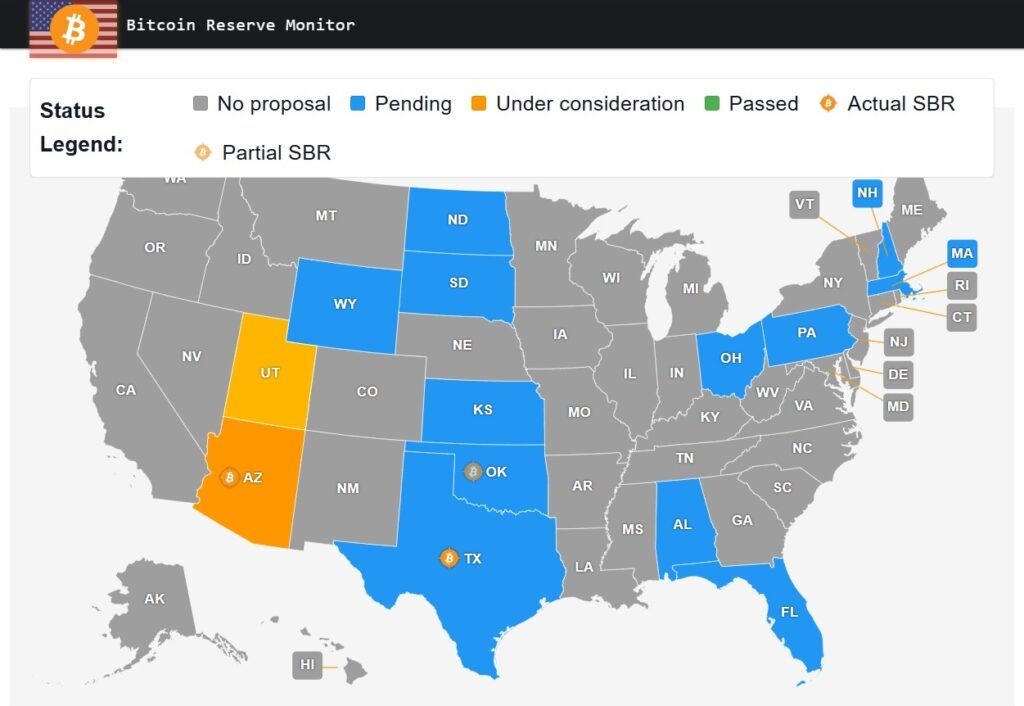

As reported by Bitcoin Reserve Monitor, 12 states have already moved forward with measures allowing their treasuries to hold and invest in digital assets.

Source: Bitcoin Reserve Monitor

Dennis Porter, CEO of Satoshi Action Fund, noted that Utah has become the second U.S. state where a crypto investment bill has made it through committee review.

But Representative Jordan Teuscher took it a step further, promising that Utah would be the first to see such legislation take effect.

While Utah is the 11th state to introduce similar legislation, we will be the first to pass it. Utah continues to lead the nation in blockchain and digital innovation!

he posted on X with a bold flourish.

In parallel to Utah’s legislative efforts, South Dakota lawmakers are also weighing crypto investment initiatives. Representative Logan Manhart has stated his intent to bring forward a bill that would create a state-controlled Bitcoin reserve.

Security First: Utah’s Approach to Crypto Custody and Staking

Utah’s HB 230 doesn’t just authorize state crypto investments—it also mandates rigorous security protocols to safeguard digital assets and regulate staking practices.

To safeguard state-held digital assets, the bill requires storage through highly secure custodial solutions, which may include qualified custodians or regulated crypto investment products.

It also authorizes the state treasurer to engage in staking and lending digital assets, provided they meet specific criteria—opening the door to a new revenue source for the state budget.

Moreover, the bill bars both state and local authorities from imposing restrictions on businesses that accept cryptocurrency payments. This policy could significantly boost crypto integration in Utah’s commercial ecosystem.

Spencer Cox — A Governor Who Supports Digital Innovation

Governor Spencer Cox has been a strong advocate for digital asset innovation. His 2022 approval of the Blockchain and Digital Innovation Task Force underscored Utah’s position as a leader in blockchain adoption.

Source: governor.utah.gov

With this pro-crypto stance, many believe that Cox will sign HB 230 when it reaches his desk, further reinforcing Utah’s leadership in the sector.

As states across the country roll out similar initiatives, Utah’s legislation could set a national precedent, advancing the role of cryptocurrency in public finance and state-backed investments.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.