Bitcoin ETF: A Year of Transformation and Insights Since Approval

Just over a year ago, the first Bitcoin ETFs made their debut on the U.S. stock market. These groundbreaking financial instruments opened the door to Bitcoin investments for both retail and institutional players, attracted billions in fresh capital, and propelled Bitcoin from a niche asset to mainstream prominence.

On this page

The launch of cryptocurrency ETFs was among the most successful in the history of the ETF market. In 2024 alone, these funds attracted over $110 billion in managed assets.

In this article, we reflect on the historic first year of Bitcoin ETFs, examining the top issuers, their impact on the broader crypto industry, and the future prospects for these game-changing investment tools.

January 10, 2024: The Launch of the First Bitcoin ETFs

After years of anticipation, setbacks, and market-shaking rumors, the U.S. Securities and Exchange Commission (SEC) approved the first spot Bitcoin ETFs on January 10, 2024. The approval led to the immediate launch of 11 funds, all vying for a share of new capital entering the market.

Related: The Journey to Bitcoin ETF Approval: A Detailed Look

Among the issuers were financial giants like BlackRock and Fidelity, each managing trillions of dollars in assets. Other key players included Bitwise, Grayscale, VanEck, ARK Invest, Valkyrie, Invesco, Franklin Templeton, WisdomTree, and Hashdex, all vying for dominance in the ETF landscape.

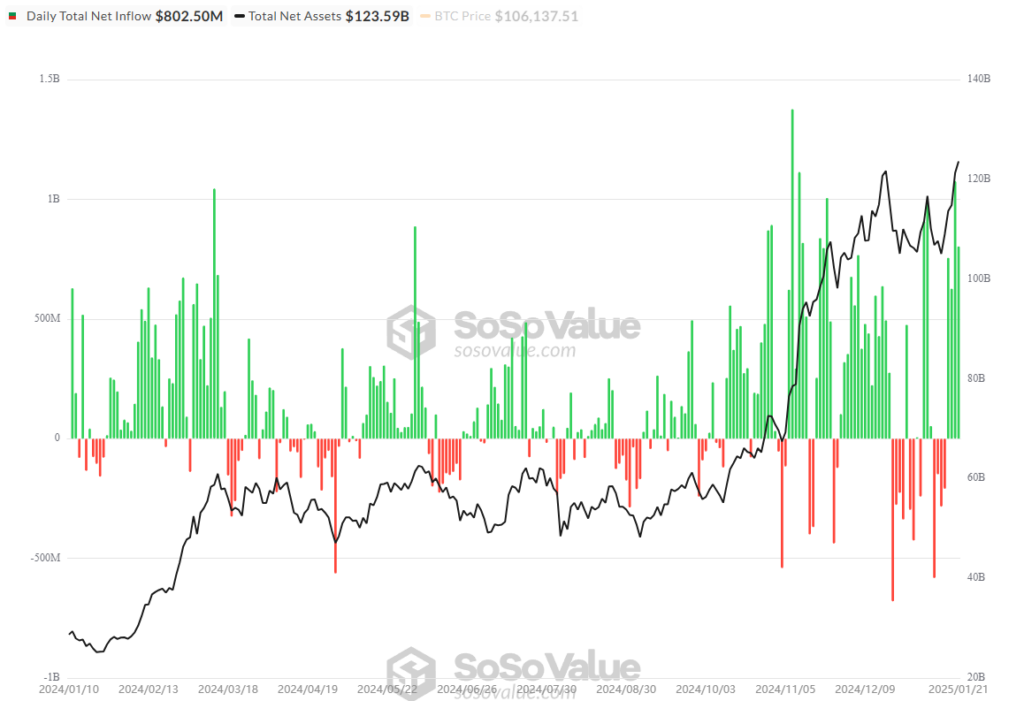

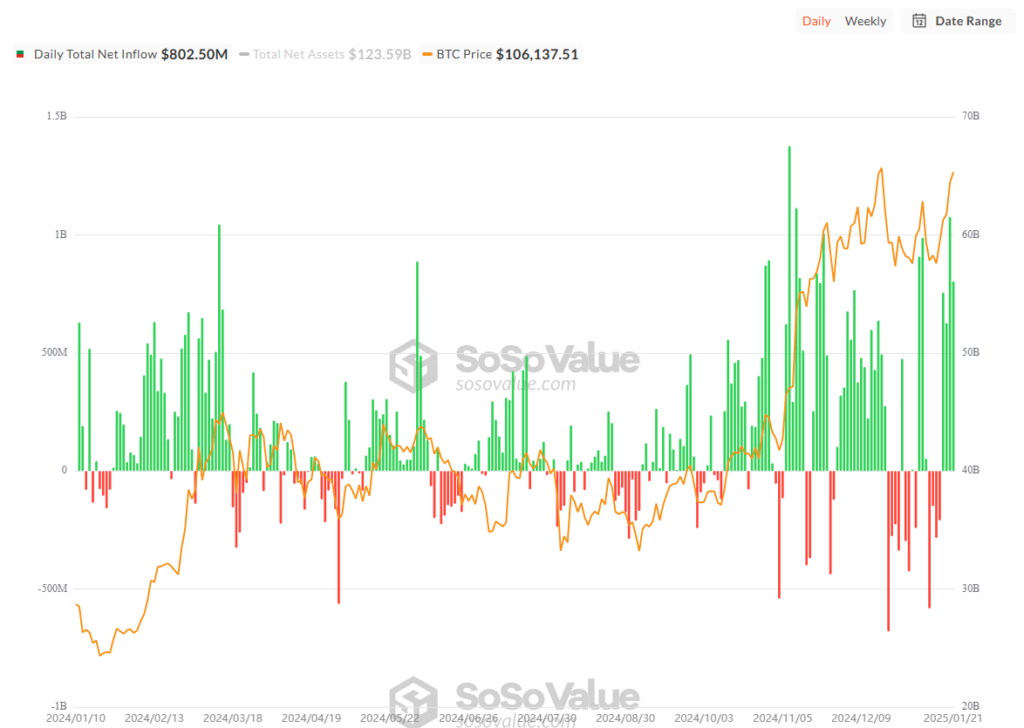

The launch triggered a surge in inflows, with Bitcoin ETFs collectively holding over 800,000 BTC by March 2024. This momentum aligned with a period of bullish market sentiment, further solidifying Bitcoin’s role across various segments of the cryptocurrency ecosystem. While summer saw a temporary slowdown, Donald Trump’s victory in the November presidential election reignited investor optimism, fueling another wave of capital inflows into the funds.

Source: sosovalue.com

Related: Who’s Sitting Out the Bitcoin ETF Race?

As of now, spot Bitcoin ETFs have attracted approximately $123 billion in net inflows and hold over 1.1 million BTC under management. This gives Bitcoin ETF issuers control of about 5.8% of Bitcoin’s total circulating supply.

To put this into perspective, Bitcoin ETFs account for just 1% of the total assets under management (AUM) across all ETFs globally, underscoring the enormous potential for further adoption of cryptocurrencies.

Bitcoin ETFs cater to three main investor groups: retail investors, financial advisors, and institutional players. The majority of buyers include retail investors alongside professional entities such as hedge funds and major financial institutions like Goldman Sachs and Millennium Management.

This growing interest reflects a broader trend of integrating Bitcoin into traditional investment portfolios, with ETFs offering a regulated and accessible bridge between conventional finance and the cryptocurrency market.

The crypto community widely expects capital inflows into Bitcoin ETFs to accelerate further. Easing regulatory barriers could pave the way for participation by pension funds, family offices, and endowments, potentially doubling the assets under management for these funds.

A Closer Look at Bitcoin ETF Issuer Performance

The performance of Bitcoin ETF issuers has varied significantly. BlackRock’s iShares Bitcoin ETF (IBIT) stands out, having accumulated approximately 540,000 BTC—representing half of all Bitcoin held by Bitcoin ETFs. Meanwhile, Grayscale’s Bitcoin Trust (GBTC) has seen its holdings drop sharply, declining from over 600,000 BTC to just 200,000 BTC, reflecting substantial outflows.

As of this writing, BlackRock’s IBIT has reached $60 billion in assets under management (AUM), surpassing the BlackRock iShares Gold ETF and further reinforcing Bitcoin’s reputation as “digital gold.” Bloomberg analyst Eric Balchunas noted that IBIT achieved $50 billion in AUM in just 227 trading days, breaking the previous record of 1,323 days set by the iShares Core MSCI Emerging Markets ETF by a factor of six.

Grayscale’s GBTC, once a leading option for indirect Bitcoin exposure, has struggled in its efforts to convert into an ETF. This has prompted investors to shift to newer Bitcoin ETFs offering significantly lower fees compared to GBTC’s 1.5% management fee. Additionally, some of GBTC’s assets have been redirected into the Grayscale Bitcoin Mini Trust (BTC), a more cost-efficient alternative.

The Impact of Bitcoin ETFs on the Crypto Market

A year-long analysis shows a strong link between net flows into spot Bitcoin ETFs and the price movement of BTC. Spot ETFs, as a consistent source of structural demand, have a notable impact on Bitcoin’s price. However, this connection isn’t always stable, as BTC’s price is also affected by broader market conditions, investor sentiment, and external factors, such as the activities of MicroStrategy and other companies adopting Bitcoin-focused strategies.

During periods of strong market growth or significant inflows into ETFs, the correlation becomes more pronounced, indicating that ETFs act as a price driver by acquiring BTC to meet client demand. Conversely, rising BTC prices can further fuel inflows as retail and institutional investors increase their capital in ETFs, creating a feedback loop.

How Spot Bitcoin ETFs Are Redefining Crypto Investing

Spot Bitcoin ETFs have attracted significant capital from both institutional and retail investors, driving sustained demand for BTC. Over the past year, these funds have demonstrated their value by simplifying access to digital assets and legitimizing cryptocurrencies within TradFi. While Ethereum ETFs had a slower start, they are gradually gaining momentum, signaling increasing interest in these investment products.

As the market evolves, new opportunities are emerging, including ETH and SOL-based ETFs with staking features and multi-asset ETFs offering exposure to a broader range of cryptocurrencies. These innovations could further enhance the accessibility and appeal of digital assets, strengthening the connection between traditional finance and the crypto industry.

The next wave of investment inflows into ETFs could act as a key driver of growth, accelerating the mainstream adoption of crypto assets.

Related: Bitwise May Launch XRP ETF, and It’s Official

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.