DappRadar: 2024 Industry Report

DappRadar’s latest report offers an in-depth look at the decentralized digital asset market, covering AI agents, NFTs, and memecoins. Who emerged as the winners, and who fell behind? Here’s a quick summary of the key takeaways.

On this page

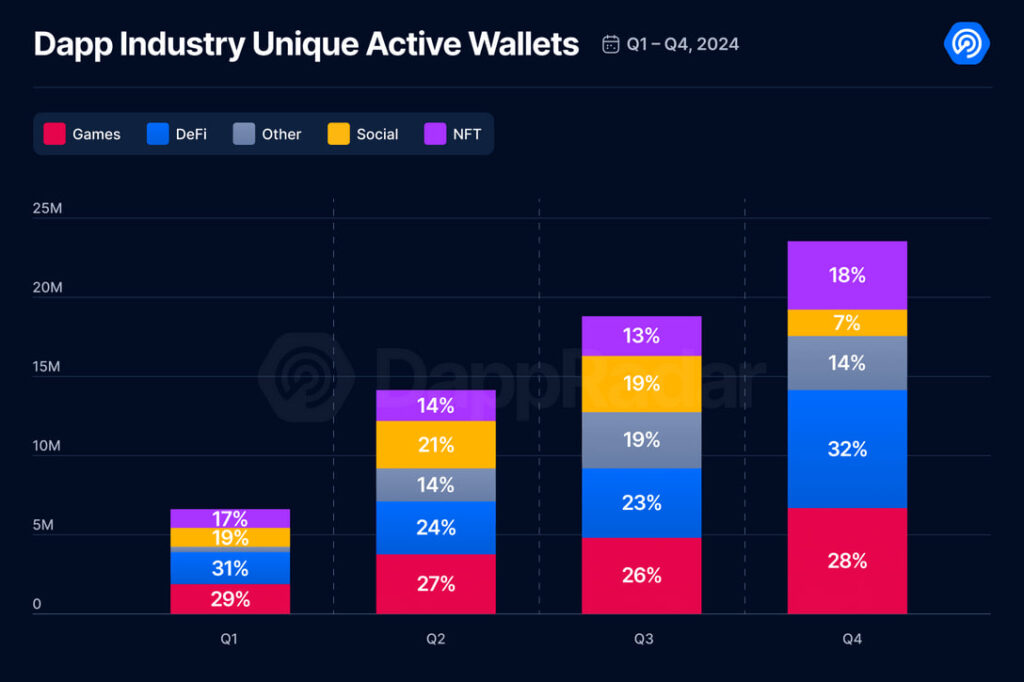

The decentralized application (dApp) industry saw extraordinary growth in 2024, with unique active addresses skyrocketing by 485%. This surge was primarily driven by the integration of artificial intelligence into dApps, paving the way for new application categories and significantly expanding their functionality.

AI-Powered dApps Dominate the Market

AI-driven dApps experienced a remarkable 2,269% surge in activity, solidifying artificial intelligence as a critical force driving the industry’s growth. The introduction of a dedicated AI dApp ranking on DappRadar underscores the growing significance of this sector.

While DeFi and gaming remained dominant categories with strong performance, AI-powered applications emerged as the standout success of the year. DeFi retained its leadership position, bolstered by the rising popularity of memecoins and AI-agent tokens, which have generated significant market buzz.

Social dApps also demonstrated a notable trend: overall activity increased by a modest 70%, but transaction volumes skyrocketed by 455%. This growth is largely attributed to the rise of quest platforms, where users complete tasks to earn rewards. The gamified approach has proven highly effective in attracting new users and boosting network engagement.

In contrast, gaming transactions, while exceeding 5 billion in volume, showed a slight decline compared to earlier in the year. This suggests that some gaming activity may be shifting to off-chain platforms or hybrid models.

The year 2024 marked a period of significant growth and evolution for the dApp industry. The integration of artificial intelligence, the growing appeal of social dApps, and the introduction of innovative user interaction formats have opened new avenues for development, setting the stage for a dynamic future in the sector.

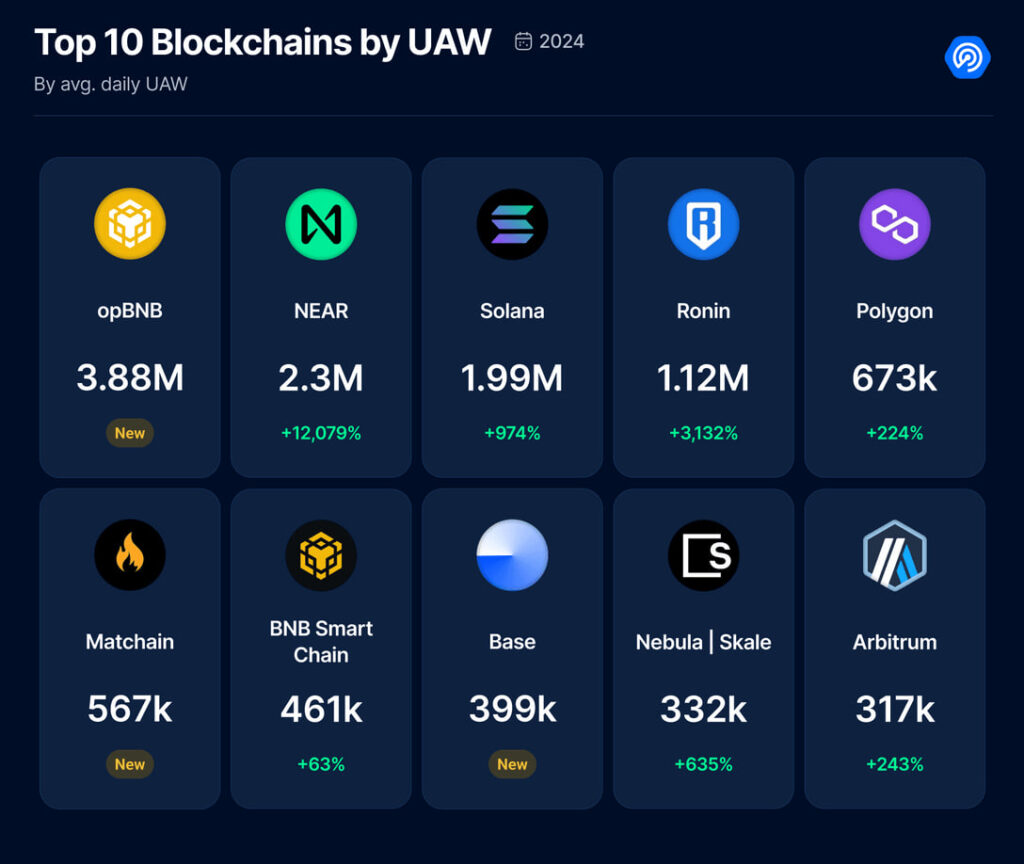

Top Blockchain Achievers of 2024

The year 2024 marked a significant period of growth for leading blockchain platforms and the emergence of promising new contenders. opBNB, using Optimistic Rollup technology, dramatically improved its performance and attracted a surge of developer interest. Similarly, Matchain and Base experienced remarkable growth, offering innovative solutions and creating compelling ecosystems for both developers and users.

Platforms like Oasis Network (ROSE) and Internet Computer stood out by providing industry-specific solutions. For example, Oasys focused on revolutionizing the gaming sector, while Internet Computer honed in on advancing decentralized applications.

The fierce competition among blockchains has become a major catalyst for innovation, fostering the development of advanced technologies and solutions. This dynamic landscape is propelling the industry forward and expanding blockchain’s reach into an array of industries and applications.

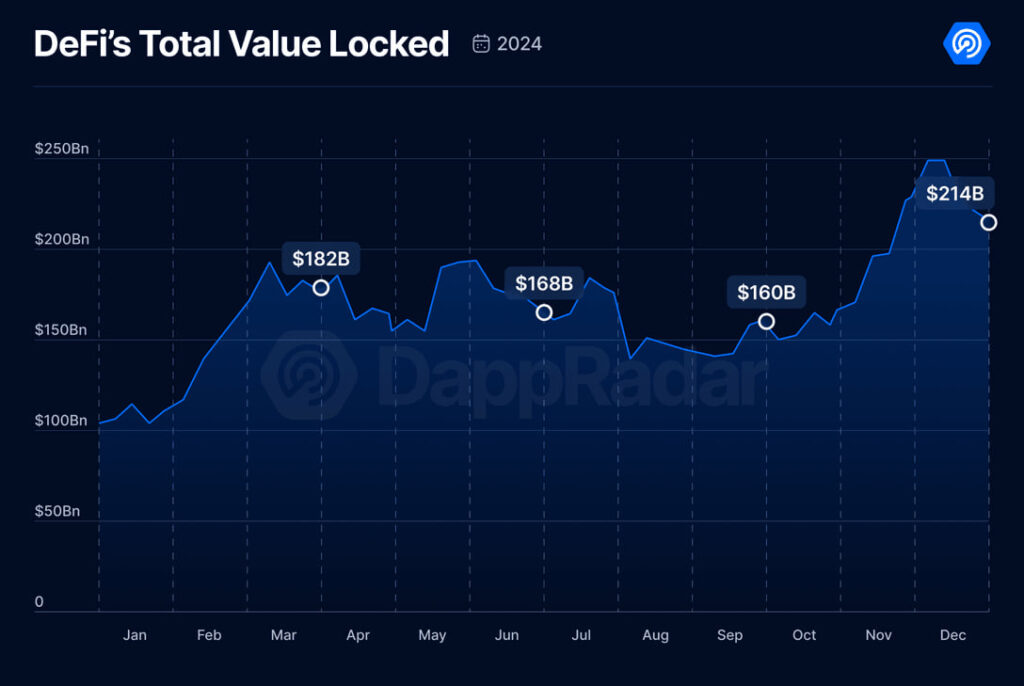

DeFi’s Explosive Growth in 2024

The decentralized finance (DeFi) sector experienced a banner year in 2024, with Total Value Locked (TVL) soaring to an all-time high of $214 billion—a remarkable 211% increase from the previous year. According to DappRadar analysts, this surge was fueled by several pivotal factors.

First, the rise of memecoins, including GOAT and Truth Terminal, injected significant capital into the DeFi ecosystem and attracted hundreds of thousands of new users.

Second, the introduction of AI agents transformed the DeFi experience. These agents automated routine tasks like trading and portfolio management, making DeFi protocols more user-friendly and accessible to a broader audience.

Third, interest rate cuts by the Federal Reserve spurred demand for high-yield investment options. Many investors turned to DeFi lending platforms to maximize returns on their assets, further driving growth in the sector.

Another key factor driving DeFi’s extraordinary growth in 2024 was increased institutional adoption paired with positive regulatory developments. The approval of spot Bitcoin ETFs, including the iShares Bitcoin Trust, became a pivotal moment, drawing significant institutional investment into cryptocurrencies and, consequently, DeFi. This inflow of capital enhanced market liquidity and bolstered trust in the industry.

Even established blockchains like Sui, Base, and Aptos recorded impressive activity growth. However, the most remarkable turnaround came from Solana. After a challenging 2023 filled with disruptions and setbacks, Solana rebounded strongly, significantly increasing its TVL. This resurgence highlighted the network’s resilience and its ability to adapt to shifting market dynamics.

Key DeFi Trends to Watch in 2025

The DappRadar report identifies several key trends that are likely to shape the DeFi landscape in 2025:

- Memecoins: Memecoins continue to play a vital role in attracting new users to DeFi, driving liquidity and platform activity.

- AI Agents: By automating complex tasks like yield farming and arbitrage, AI agents are making DeFi more accessible to a broader audience, including newcomers.

- Tokenization of Real-Word Assets (RWA): Integrating real-world assets into DeFi opens new investment opportunities and increases global liquidity.

- Layer 2 Scaling Solutions: Technologies like Optimism, zkSync, Arbitrum, and Base will remain essential for scaling DeFi and reducing transaction costs.

- Bitcoin Ecosystem Growth: The development of Bitcoin Layer 2 solutions has enabled Bitcoin-based dApps, expanding its functionality. Projects such as Keep Network and THORChain (RUNE) are positioned to lead this segment.

- User Engagement Incentives: Point systems and airdrops have proven effective for attracting and retaining users in DeFi ecosystems and are expected to remain popular.

- Cross-Chain Bridges: Interoperability through cross-chain bridges is enhancing DeFi’s functionality. Demand for innovative cross-chain solutions is projected to grow in the coming year.

Crypto Market Underperformers in 2024

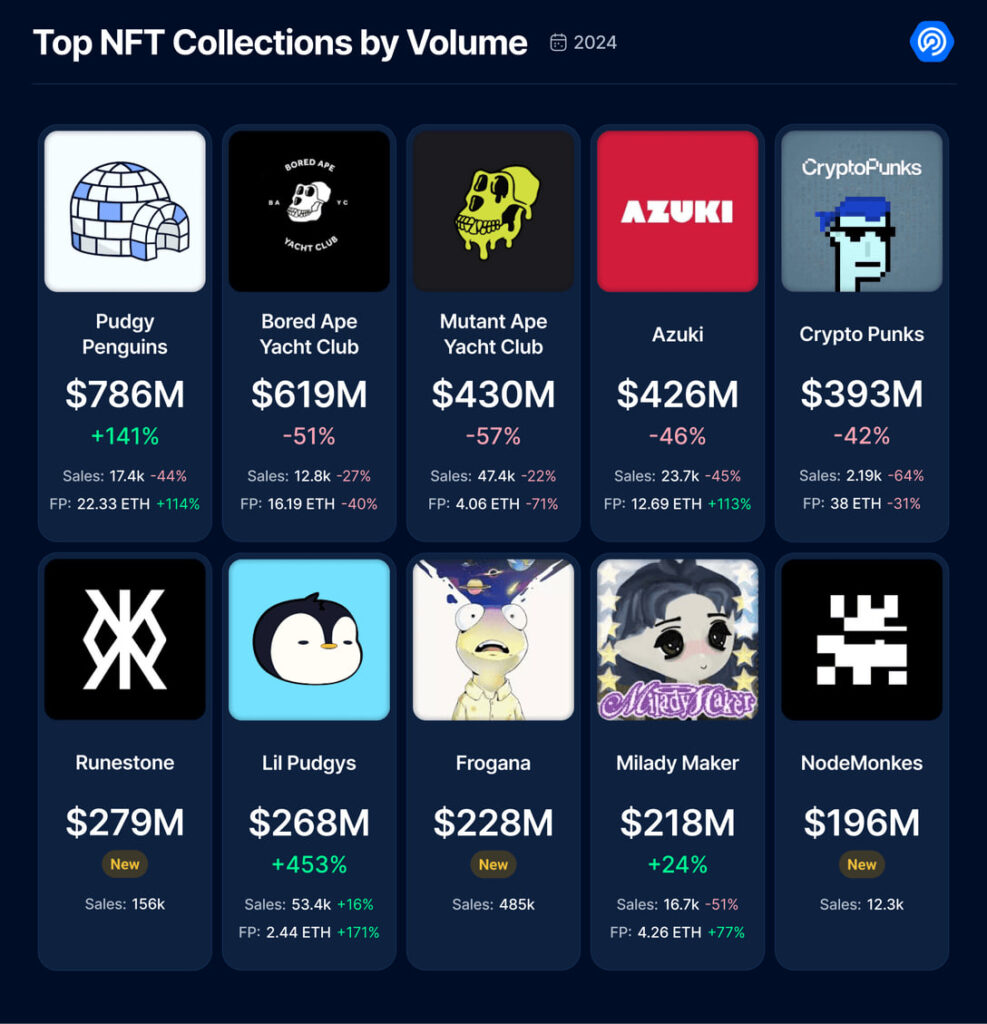

The NFT market faced significant challenges in 2024, with mixed outcomes despite some standout projects and successes.

The numbers tell the story:

- NFT trading volume dropped 19% compared to 2023, and the number of sales fell by 18%. This suggests the market has transitioned from rapid expansion to a phase of consolidation—or possibly stagnation.

- The average price of NFTs rose by 10%, driven by the introduction of more expensive and exclusive collections that appealed to high-value investors.

- Gaming NFTs led the market in sales, highlighting gaming as one of the most promising sectors for NFT growth.

Projects like Pudgy Penguins showcased the potential for NFTs with real utility and strong marketing strategies to thrive in a challenging market. Strategic brand partnerships and a focus on gaming development allowed the project to solidify its position.

These trends point to market saturation and waning interest from retail investors in short-lived projects. Buyers have become more selective, prioritizing NFTs with long-term potential and tangible value.

The competition for dominance in the NFT market was particularly intense in 2024.

In 2024, Blur established itself as a market leader by employing an aggressive marketing strategy and offering zero-fee trading, enabling it to secure a significant share of the NFT market. Meanwhile, OpenSea, grappling with regulatory challenges and declining demand, was forced to downsize its workforce and overhaul its business model. On the other hand, Magic Eden, initially focused on Solana, successfully expanded its reach to other networks and surpassed OpenSea in trading volume.

The year demonstrated a key takeaway: thriving in the competitive NFT market requires constant adaptation to changing conditions and a strong focus on innovative solutions for users.

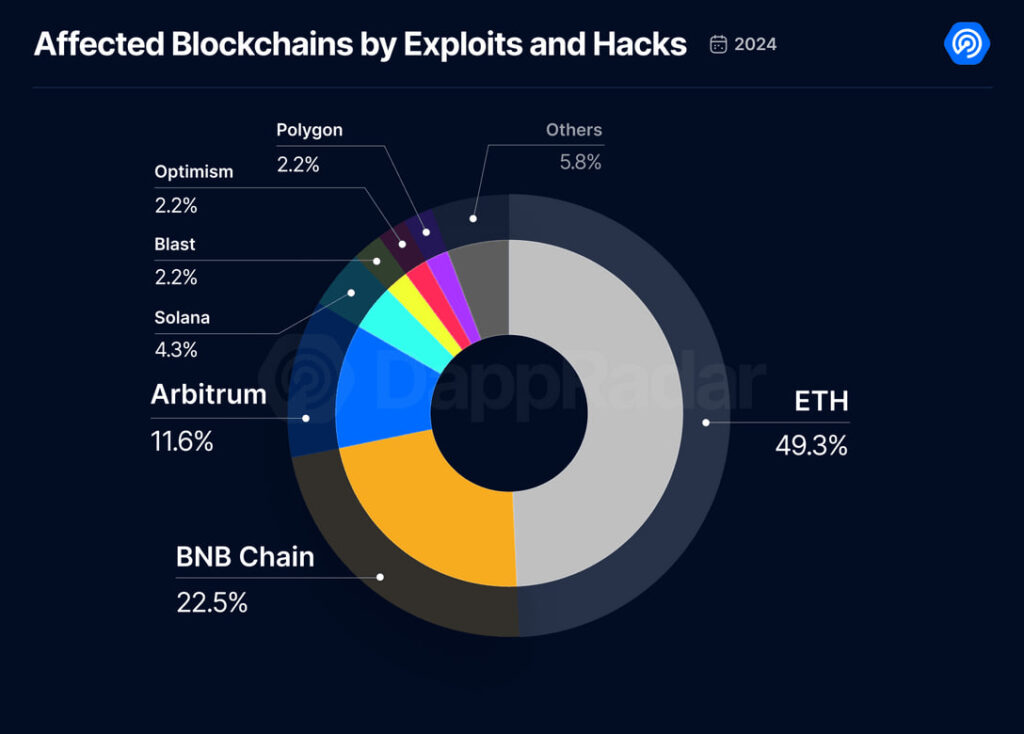

Fewer Hacks, but Threats Linger

Although 2024 saw a 31% reduction in total losses from hacks and exploits within the DeFi sector, this improvement doesn’t mean the industry’s security issues are fully resolved. The ecosystem continues to face serious threats, necessitating constant vigilance and the implementation of innovative security measures.

As the largest and most established DeFi platform, Ethereum remains a primary target for hackers. The complexity of its smart contracts, frequent updates, and an ever-expanding number of integrated projects introduce numerous potential vulnerabilities. Furthermore, Ethereum’s pivotal role as a bridge for cross-chain transactions significantly increases its exposure to cyberattacks.

Security analysis for 2024 identified access control vulnerabilities as the most common attack vector. Hackers leveraged weaknesses in authorization and authentication mechanisms to gain unauthorized access to user funds. This underscores the importance of prioritizing strong access control measures during the development and auditing of smart contracts.

Despite advancements in security measures and regulatory oversight, rug pulls remain a persistent threat within the DeFi ecosystem. These fraudulent schemes, designed to exploit investor trust and vanish with their funds, continue to emerge at an alarming rate, eroding confidence in the sector. Addressing this issue requires not only enhanced security protocols but also a focus on improving financial literacy among users to help them identify and avoid high-risk projects.

Key Insights from the 2024 Report

The dApp industry experienced remarkable growth in 2024, with significant contributions from AI-powered applications, DeFi, and gaming. The debut of new networks like opBNB and Matchain added diversity to the ecosystem, further fueling innovation.

DeFi maintained its leadership position, achieving a 211% increase in Total Value Locked (TVL). Notable players like Solana, with a staggering 2000% surge in TVL, demonstrated the sector’s immense growth potential.

The NFT market faced volatility, with declines in trading volumes and sales. Despite this, projects offering real utility remained resilient, while gaming-related NFTs continued to dominate.

Security remains a critical challenge. Ethereum continues to be a prime target for hackers, with authorization vulnerabilities emerging as the most significant threat to the ecosystem.

Header image source: dappradar.com

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.