Jack Dorsey’s Block Poised to Enter the S&P 500 Club

The growing integration of cryptocurrencies into traditional finance (TradFi) is hard to ignore. Jack Dorsey’s Block, with its long-term Bitcoin accumulation strategy, is now on the cusp of joining the prestigious S&P 500 index.

On this page

Block’s inclusion in the S&P 500 seems increasingly likely, with its market capitalization now at $51.15 billion. This figure surpasses the valuations of existing index members like Axon Enterprise Inc. ($43.47 billion) and General Motors Company ($50.9 billion).

What Is the S&P 500?

The S&P 500 is one of the world’s most prominent and influential stock market indices. It tracks the performance of 500 of the largest publicly traded U.S. companies by market capitalization, covering a wide range of industries, including technology, retail, and healthcare.

Often seen as a barometer of the U.S. economy, the S&P 500 reflects overall economic health. A rise in the index typically signals growth, while a decline can indicate potential economic challenges.

The S&P 500 is a key benchmark for investors measuring portfolio performance. Index funds that replicate the S&P 500’s movements are among the most popular investment options globally. Additionally, the index underpins futures and options contracts, which are widely used for speculative trading and risk management.

The S&P 500’s composition is regularly updated to reflect changes in the economy. Companies are added to the index if they meet key criteria, including sufficient market capitalization, financial stability, and stock liquidity. Conversely, companies may be removed if their financial performance declines or they are acquired by another entity.

A dedicated committee oversees the selection process, conducting annual reviews to ensure the index remains a reliable representation of the market.

Why the S&P 500 Matters to the Crypto Industry

The inclusion of a crypto-focused company in the S&P 500 is more than a mark of prestige—it sends a strong signal to the millions of investors who track the index. It demonstrates that the company’s business model and strategy are not only credible but also positioned for substantial growth.

For the crypto industry, the potential inclusion of Block (formerly Square) in the S&P 500 would further validate virtual assets in the eyes of traditional financial institutions, solidifying the bridge between the cryptocurrency sector and mainstream finance.

Block: A Steady Strategy with a Long-Term Vision

While MicroStrategy has focused on making large, one-time Bitcoin purchases, Block has adopted a more measured approach, gradually building its BTC reserves through consistent investments. Jack Dorsey has dubbed this strategy “Block Up,” which is based on the Dollar Cost Averaging (DCA) principle.

How the Block Up Strategy Works

- The company allocates a set percentage of its monthly profits to Bitcoin purchases.

- The purchase amount remains fixed, regardless of whether Bitcoin’s price is rising or falling.

- By buying Bitcoin regularly, Block reduces the risks associated with market volatility. If the price drops, the average cost of its holdings will be lower compared to making a single large purchase.

For a more detailed explanation of this approach, check out our article: “DCA Explained in Simple Terms.”

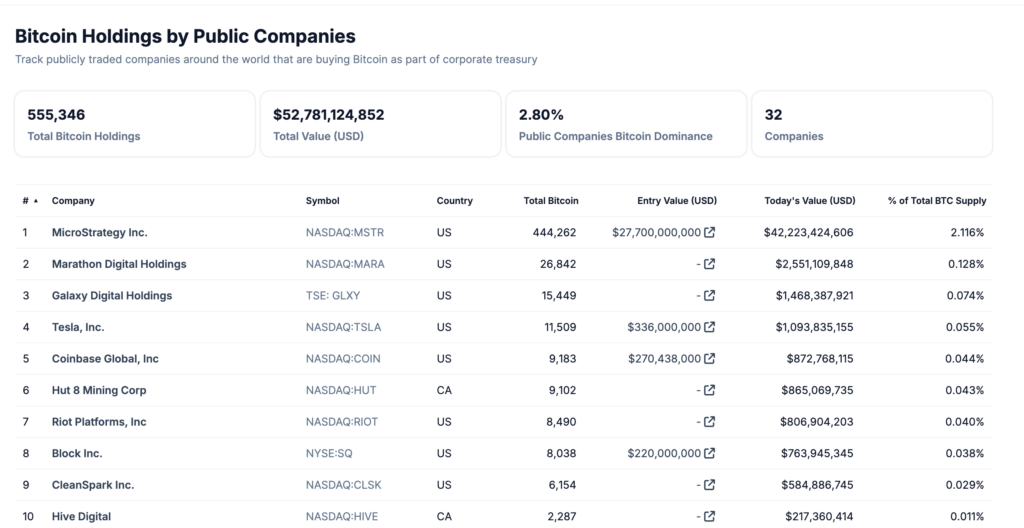

As of January 10, 2025, Block holds 8,038 BTC in its cold wallet, according to data from Coingecko. Jack Dorsey began acquiring Bitcoin for the company several years ago, cementing Block’s position as a major institutional holder.

MicroStrategy on Nasdaq, Block Sets Sights on S&P 500

MicroStrategy, a pioneer among publicly traded companies embracing Bitcoin, has demonstrated that adopting “digital gold” as a primary reserve asset is not only feasible but can also deliver substantial returns. Its bold strategy of making Bitcoin the cornerstone of its reserves has inspired others to follow its lead.

However, Block’s bid to join the S&P 500 carries even greater significance than MicroStrategy’s established presence on the Nasdaq.

How Nasdaq and the S&P 500 Differ

The Nasdaq and the S&P 500 are two of the most influential U.S. stock market indices, but they differ significantly in composition and focus.

Nasdaq (National Association of Securities Dealers Automated Quotations) serves as both a stock exchange and an index, primarily known for its concentration of leading technology companies. The Nasdaq Composite Index largely reflects the performance of the tech sector, making it a symbol of innovation and technological advancement.

Nasdaq includes some of the world’s biggest and fastest-growing tech giants, such as Apple, Microsoft, Amazon, and Google. However, this heavy focus on technology also makes the index more volatile compared to the broader S&P 500.

S&P 500 (Standard & Poor’s 500), by contrast, tracks the performance of 500 of the largest U.S. companies by market capitalization across a wide range of industries. Unlike Nasdaq, the S&P 500 includes companies listed on multiple exchanges, such as the New York Stock Exchange (NYSE), making it more diversified and a better barometer of the overall U.S. economy.

If Jack Dorsey’s Block secures a place in the prestigious S&P 500, it would mark a pivotal moment. It would place the company among an exclusive group of established corporate giants, challenging traditional financial norms. Such a move would send a strong message that cryptocurrencies are becoming an essential component of corporate portfolios in mainstream finance.

For more insights into Jack Dorsey—the Twitter founder and billionaire shaping the future of technology and finance—read our article: “Jack Dorsey: ‘Bitcoin is the Internet’s Native Currency.’”.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.