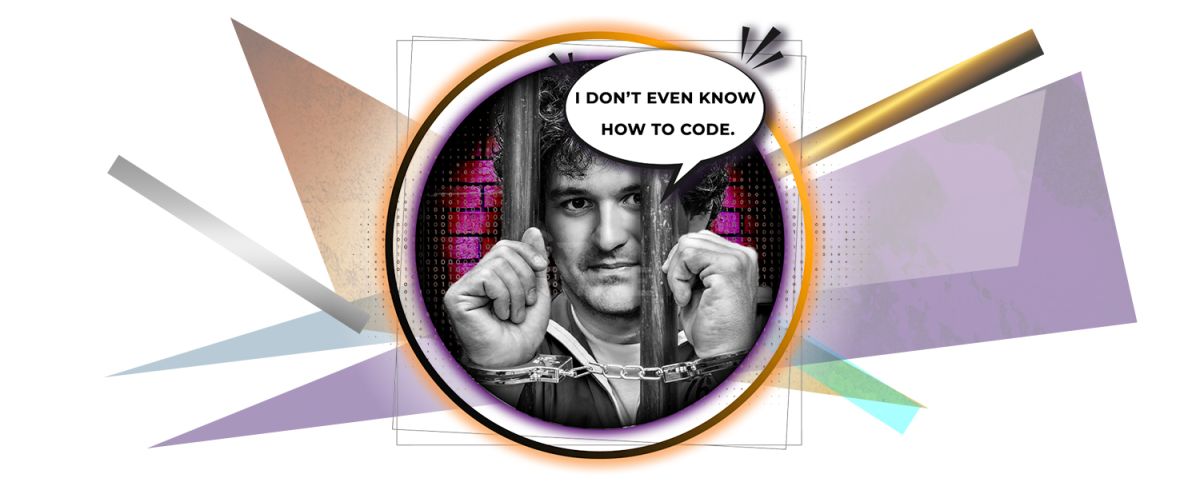

Sam Bankman-Fried: “I don’t even know how our system works”

Sam Bankman-Fried gave his first phone interview with YouTuber Tiffany Fong. It instantly hit social networks, and quotes from it scattered throughout the crypto community faster than hamster memes during a short squeeze.

On this page

The interview given by the CEO of FTX is not the one that sheds light on the reasons for the “Curly Sam” empire collapse. It resembles an emotional monologue of a teenager, who says that it was not he who stole the money, but the bad boys set him up.

During the interview he mentioned several times that his lawyers do not approve of his public appearances. The obvious question is: “Why did you agree to the interview then? And why did you post on Twitter telling all the people about the ongoing investigation?”

It turns out that the lawyers who will represent Sam in court are categorically against him admitting his guilt in the bankruptcy of the crypto exchange.

They said I had to promise that I would never say again that I screwed up! And I told them to go to hell.

Therefore, he decided to explain in detail why he was not to blame for what had happened. But it would have been better if Sam had kept quiet. Because his conversation with Tiffany Fong only raises eyebrows: “How could this person lead the largest digital company in Europe and the USA?”

Here are some quotes from the interview:

I certainly wasn’t like building some back door in this system. I could barely use the system. I knew this system from a user interface perspective. I was incorrect on Alameda’s balances on FTX by a fairly large number and an embarrassingly large new one, and it was because of a very poorly labeled accounting thing. There was a fuck up. I was wrong on our balances because of mislabeled accounts. It was an artifact from an old wiring system.

Basically, he says that it's not his fault. That he didn't understand and did not want to understand how the system, where the money of millions of users is circulating, works. The accounting department is to blame because it incorrectly kept records.

He followed with an even-odd remark that FTX collapsed not because of a liquidity crisis, but because there was a “massive free market adjustment.”

Liquidity wasn’t what caused that crash. What caused the crash was something else which is very embarrassing that I underestimated, which is the massive correlation of things during a free market moves, especially when they’re triggered by peer over the position itself and the massive size of those moves,

Sam was not even able to answer what are the advantages of the FTT token and what this token backed with. His answer sounded like a poor attempt to joke:

FTT had real value. It was more legit than most tokens in many ways. Because of buy and burn and shit. It’s not a token that does nothing. I don’t know. It’s better than token number 17 on Coinmarketcap.

When asked why he opened the possibility for withdrawals only for clients from the Bahamas and whether there were any subjective reasons for such a decision, he replied:

I gave [the Bahamian government] a one-day heads up that we were going to do it. They didn't say, yes or no. They didn't respond, and then we did it. The reason I did it was it was critical to the exchange being able to have a future. You do not want to be in a country with a lot of angry people in it and you do not want your company to be incorporated in a country with a lot of angry people in it. This was us trying to create a regulatory pathway forward for the exchange just to like kind of appease the citizens of the country that we’re currently in.

Does Sam Bankman-Fried have any regrets? As it turned out – yes. He regrets that he spent too much time trying to find a common language with regulators and get all the necessary licenses:

At this time, we could be more selective and spend less time on these negotiations.

He also regrets “being forced” to file for bankruptcy. He still does not realize (or pretends not to realize) the amount of damage he has caused to clients and creditors:

FTX US was so fucking solvent that even after we lost $250M to a hack after the bankruptcy we were $500M over.” “I had four billion additional dollars of funding come in 8 minutes after I signed the Chapter 11 papers. That money could have gone to make users whole but our trustees would rather burn down this entire operation out of shame than attempt to bring more value to customers.

Sam still believes that everything can be recovered. He believes that he can fix everything and become the CEO of FTX again.

If they sent me the AWS keys tomorrow we could open withdrawals again in the next months.

The reaction of YouTube viewers was harsh. One of Sam's Twitter followers wrote:

This confirms my hypothesis that SBF is a manipulative/sociopathic liar who takes perverse pleasure from his PVP games in real life.

Every day there are more and more calls for Bankman-Fried to be extradited to the US and charged with fraud.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.